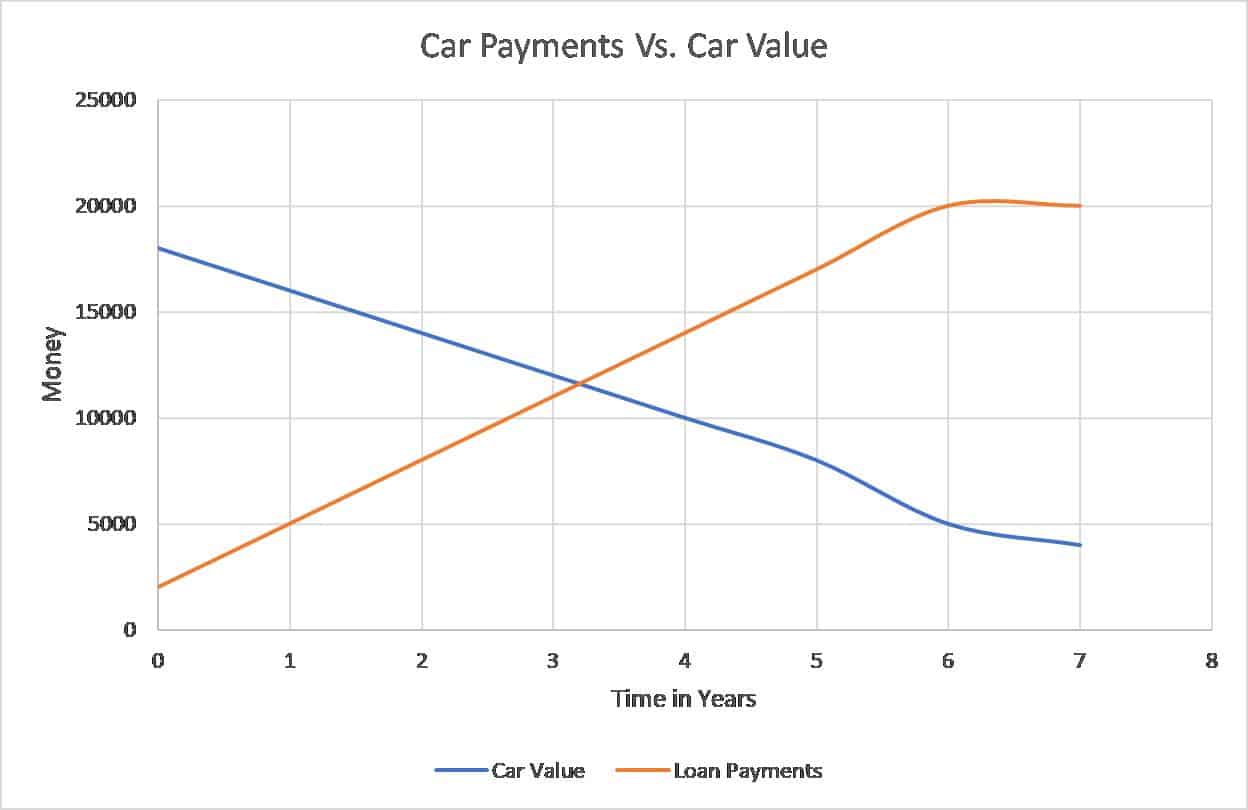

Never buy a new car PERIOD. Its a completely needless expense you will take which is almost guaranteed to drain money out of your pocket. First up let’s look at a graph of car’s value and car loan payments after its bought new. Let’s try and track it along the course of its lifetime. I am mostly using the cars values from public sources and websites and trying to plot them on a graph:

Let’s say you paid 2k$ down for a new vehicle(total price = 20K). We see that the moment you buy a new one and drive it off the lot. Its value decreases by at least 10%. What you will find is its already worth 18K if you try and sell it back to the dealer same day. Talk about a liability taking money out of your pocket! If we keep plotting your monthly car payments as expenses, you can see how your expense on the car keeps going up and up and look at the value of the car as it keeps slowly decreasing year by year. Over years 3-5 its already lost about 40-50% of the value of the new car! All these expenses are just monthly loan installments. We have not even included any car repairs or insurance payments at all in the above graph. So, when you take all those expenses into account, I hope you do realize that buying a brand-new car is just draining your hard-earned money down the hole.

Instead you can simply buy a car that’s 3 years old and still get same level of performance and it depreciates a lot slower as compared to a new car. I personally got a 3-year-old Camry from a third party dealer which has worked out really good for me so far! I still use it and have had barely any problems. Any small repairs I do myself like changing aux ports, filters etc. and haven’t really had to spend too much on any major repairs.

When it comes to lease, what you are paying for is that high rate of depreciation on the vehicle. The 160-200$ payments which look pretty good at the start make you only pay for the fast decreasing value of the vehicle. Once at the end of the lease you decide to say buy the car, the manufacturer will ask you for 300$ monthly payments now not your 200$ payments!

With all this in mind, I can only say that we should realize that a car is a liability in the long run whose value is almost always bound to go down to 0. A car is probably the second largest purchase you will make. In order to be wealthy as we know we need to have more assets than liability! So ideally, we should try to reduce as much as possible of this liability and here are some alternatives:

1. Used cars

Instead of getting a brand-new car, 3-4 years old used cars are often reliable. Cost very less and do not have many expenses at all. I personally got a 3 year old used car which has barely given any problems. It has worked real good so far! I do minor repairs like aux port changes, filter changes myself. Then take it for inspection once a year to see if I need any changes.

2. Public transportation

If you live in big cities like New York, Chicago or Seattle, you should make use of the public transportation system. I even have a few friends in cities like Houston and Dallas that are not that much known for their transportation. But they have been able to make really good use of public transportation for their day to day routine.

3. Uber/Lyft

These days ride sharing apps are all the buzz. Its possible to use these apps and completely give up your vehicle. If you add expenses for your vehicle like insurance, monthly payments and fuel costs. Most of the ride sharing apps have monthly ride passes which are very cheap. They also offer very competitive discounts since they are new. You may be surprised to know sometimes using ride sharing apps is a better option then owing a car.

Let me know in the comments if you have any questions or how your car buying experience went!