From my first article on being wealthy, we know Net Worth = Assets – Liabilities. Its a sum total of how much you are worth. It gives an idea about financially how healthy one is.

Why should I track my Net worth?

1. Important piece of data

Unless you do not sit down and find your net worth, you have no way of knowing how much wealth you have. You have no way of making any decisions that might help you grow wealthy. You have no idea if you are in deep trouble or are doing great for your age/situation etc.

2. Keep you on track to Financial Independence

How would you know if you are on your way to becoming financially independent or not? Its easily possible you are losing money every month and not realizing it. Tracking your net worth in fixed intervals allows you to be in check with the reality.

3. Make smart financial decisions

Do you know if you are in a healthy position to take a big loan? What if a big debt you have needs to be paid down faster or not because of high interest rate? Do you know if you need to increase investments in order to get higher return to get where you want to be? All these decisions require information about net worth. How much cash do you have on hand etc. Without knowing this information, its easily possible to make bad decisions and land in sticky situation few years down the line. Maybe you find you are spending way too much money every month. This might lead you to dig deeper to figure out where and how you can reduce that. Maybe that encourages you to start meal prep. Stop eating out daily. Reduce costs etc.

4. Makes you a businessman/woman

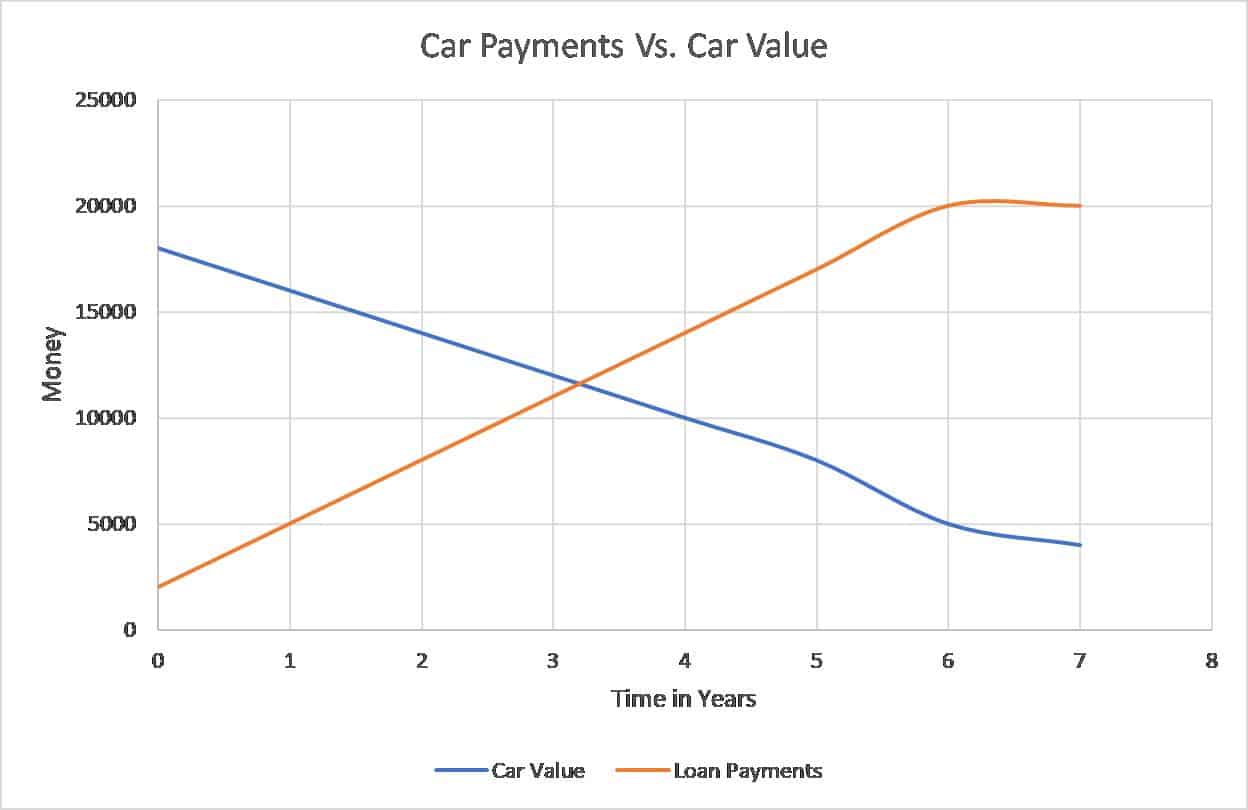

I strongly believe a house needs to be run as a business. Every few months family/concerned people need to sit down. Figure out the net worth. See how many accounts increased in value. See what went down in value. This would give so much more information to make decisions and move towards financial independence together. It gives you better understanding if an item is an asset or a liability. For e.g. if you keep tracking your car loan payments and car value using KBB every few months, it would help you realize you keep paying down your car loan amount every month. But the car value also keeps decreasing. You realize that car is taking money out of your pocket and reducing your net worth slowly. Many people keep on leasing a car every few years not realizing they keep paying money to do so. Reducing their net worth slowly and steadily.

5. Give encouragement and motivation to yourself

Once you start tracking your net worth. You start making smarter financial decisions. It just becomes way simpler to decide to take a loan or not, to go on a costly trip or not with that information in mind. You start spending money wisely once you understand your net worth needs to go up for you to become wealthy. When you track it and see that line going in the top right direction. It makes you feel good! Its gratifying! It encourages you to make even better decisions. Also gives you motivation to keep going! It can also give you great motivation to dig yourself out of debt if you have any.

How to track your net worth

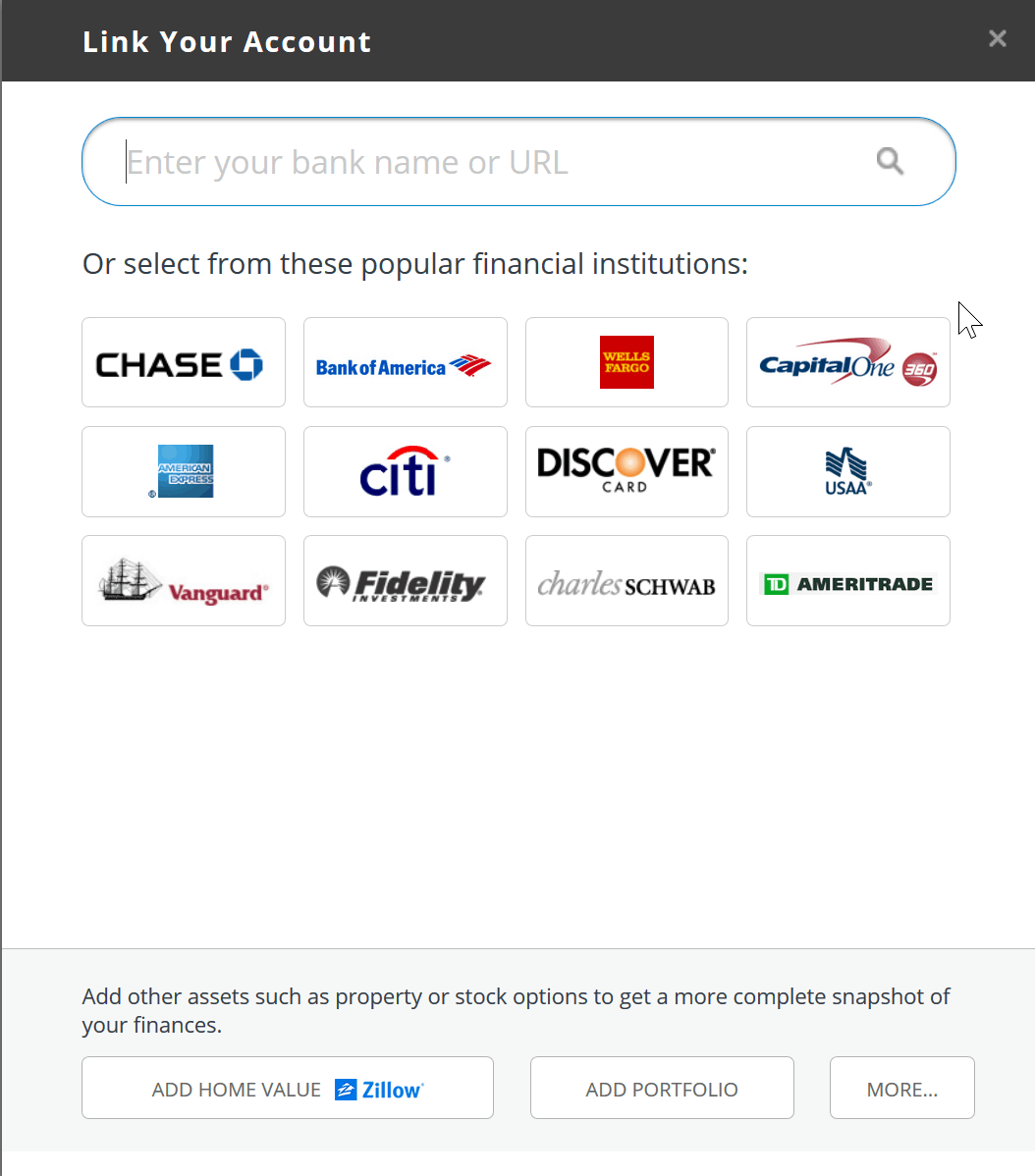

There are lot of apps/websites on the market which allow you to sync all your accounts and track net worth. However, the process in each case is the same. You create placeholders/accounts for each type of item. Checking accounts, saving accounts, car loan, house mortgage, house value, car value, investments. Everything can have 1 account each. Then you group them into assets and liabilities. Some of the asset accounts would be checking, saving, investment accounts etc. Liabilities would be car loan, house mortgage etc. If you are having a hard time figuring out what goes under assets and what goes under liabilities. Do not worry. Most apps/websites already group this for you and ask you to just enter the information. After you have your assets and liabilities, you just subtract them to get your net worth. It’s that simple!

Manual or online the lazy way?

A plethora of apps like Mint/Personal Capital etc. give you the ability to simply connect your checking, saving, investment accounts directly to their app. This allows the amounts to be synced automatically. You do not have to do anything. While this sounds easier to do, I have a few issues with this approach:

- Sometimes banks change their secured login API’s and most of these apps are not quick to change it on their end. What if your app tries to connect 2-3 times and bank ends up locking your account for this reason?

- Secondly, I do understand that these type of connections for Mint to my bank account are very secure. They provide read only access, no one can make a transaction using that access etc. But, I still do not want to be in a position where some new sophisticated attack manages to take some other useful information using this type of connection. What if the bank refuses to acknowledge any fault if I am in a pickle, citing third party connections?

- Lastly, I think doing it manually once every quarter forces you to be involved in the process. If you do an automatic sync, you are less likely to focus on it. With automatic sync, you might not even know when your net worth increased or decreased. Doing it manually forces you to take time out of your routine to sit and look up each account and enter the balance in the app/website. The more time you spend doing that, more you would think about it. It’s reinforcing the whole concept of tracking net worth to motivate and encourage yourself. That’s why I like to track my net worth manually every quarter.

How often to track net worth?

According to me one needs to do this manual exercise of going through all accounts once every quarter. It doesn’t need to be daily since that would be an overkill. You got to spend more time on other productive things. You do not want to do it only 1 a year, because by year 2 you would have forgotten about it. Doing it once every few months will force you to be in check with reality of your financial health. You can even start doing it once every month in beginning to get a more detailed idea of finances. After a few months you can switch to quarterly intervals. Again it is very gratifying to see your efforts and decisions take that net worth line to the top right in your chart.

My choice for tracking net worth: Personal Capital

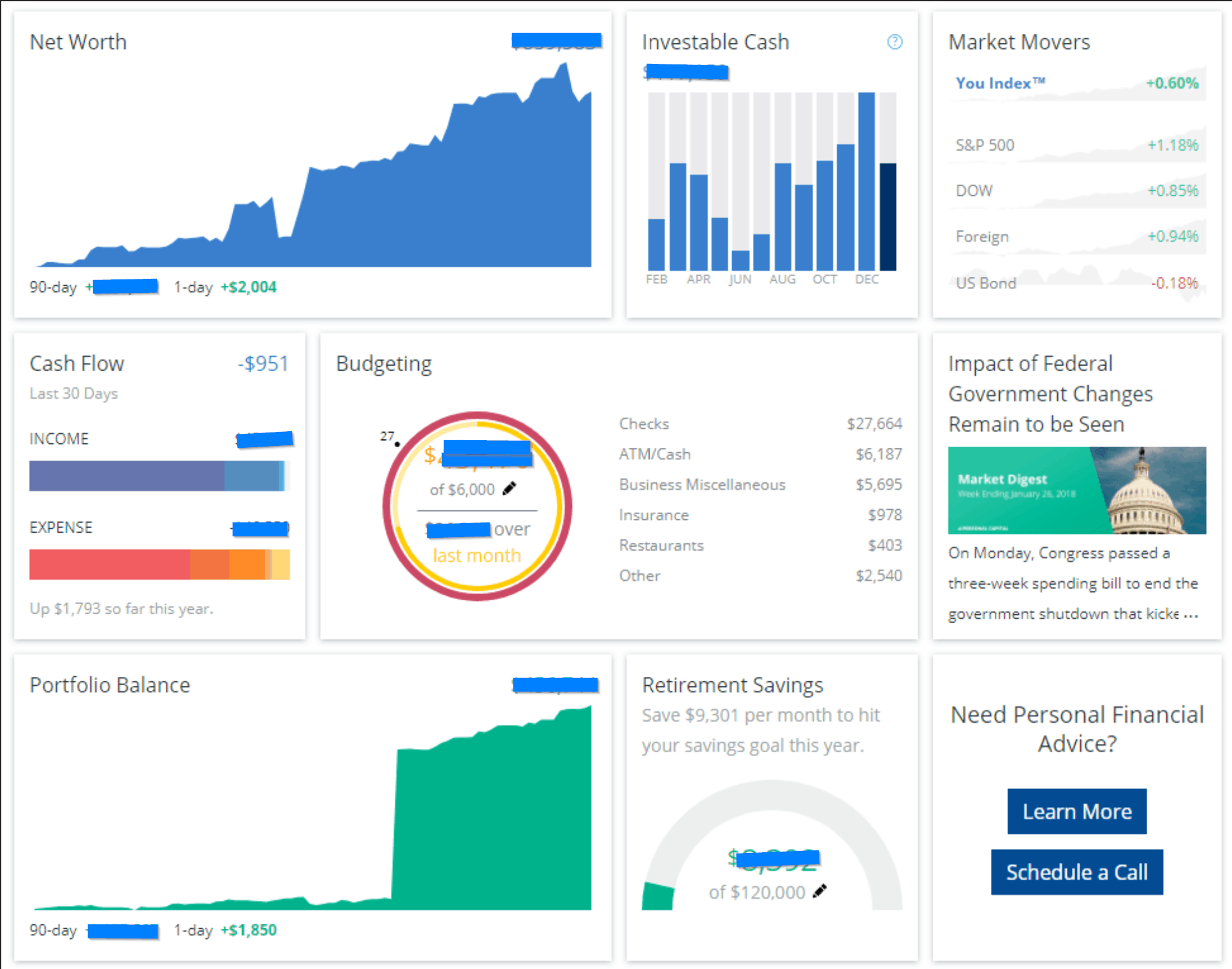

Key highlights

- It’s a free app/website on available for both Android and iPhone.

- Very easy to use interface to enter accounts manually.

- Excellent charts/graphs to show your progress over time.

- Connections to do real time sync with many different type of accounts. Although as I mentioned before I usually do not even use this feature.

- In conjunction with above, it even has inbuilt portfolio, 401K analyzers. However, these again need you to connect your accounts to the service. So I don’t really use them. Since I do manual account setup.

- The UI to look at charts and arrangement is great! I can easily say there is nothing else on the market with such great UI. Just look at some pictures below.

Shortfalls

- Fair warning, once you reach a net worth of about 100K, Personal capital calls you to schedule advisor sessions with them. They make money using their advisory services which are totally optional. The app is completely free. I usually just politely decline such calls. But do understand that you will get them.

- They even have a budgeting tool, which is a new feature and I think it still needs polish. But having said that again, I do not use this feature. I solely use this app to track my net worth. So, for me its not a big negative.

Here is a direct link to sign up for free.

In Conclusion

Some of us have performance reviews at work. We usually track our work done in the last few months and discuss that with our managers. Similarly tracking net worth helps you keep performing better financially. Smallest of financial decisions taken today will help you 10-15 years down the line. When you see your net worth in black or red, you are forced to face the reality. It helps you keep grounded in your journey to financial independence.

Disclaimer: Links in this article are my referral links. I and you will get 20$ Amazon Gift card for signing up to Personal Capital. I have signed up and have found the app pretty useful for my own self and decided to share this with readers.

I keep hearing from my friends and reading from a lot of articles that we should avoid using credit cards. Most of them suggest that use of credit card essentially means using money which you don’t have. Credit cards incite you and encourage your spending behavior. They make you careless about your lifestyle and finances. Before you realize you will be falling down the credit card debt spiral.

I keep hearing from my friends and reading from a lot of articles that we should avoid using credit cards. Most of them suggest that use of credit card essentially means using money which you don’t have. Credit cards incite you and encourage your spending behavior. They make you careless about your lifestyle and finances. Before you realize you will be falling down the credit card debt spiral.