If you received Employee Stock Purchase Plan (ESPP) or Restricted Stock Units (RSU’s) from your employer and you sell them within 2 years. You may have noticed that the reported income your company reports on W2 box 1 is way more than the money you were actually paid in salary. This is because they also include some amount from ESPP and RSU’s as your income. You also get a 1099-B from your broker with details of transactions. But if you do not fill your tax return properly you might end up getting taxed twice on any ESPP and RSU you sold the previous year.

How do you get double taxed?

Your broker sends you the 1099-B form to report the gain/loss on sale of transactions. However, the cost basis that they put in these transactions(ESPP/RSU) is usually incorrect. When you enter this information directly from your 1099-B to a tax return software like or Turbo Tax without making adjustments to the cost basis, you are taxed twice/double on the stocks which you were granted.

On the ESPP side let’s look at an example.

| ESPP Events | Amounts |

| My contribution in a quarter for 1 Lot | 2774.20$(gets taxed from regular paycheck) |

| My cost of basis with 15% discount on W2 | 2358.07$ |

| Selling price of 1 Lot | 3022.66$ |

| So according to my broker (on 1099-B), my gain | 664.59$(3022.66-2358.07) |

| Actual gain | 248.46$(3022.66-2774.20) |

However, I had contributed 2774.20 and paid taxes on that amount from my paycheck itself. So that means my actual gain which I should pay taxes on should only be 3022.66-2774.20 = 248.46$.

Hence I need to make an adjustment to my cost basis so that its 2774.20 and not 2358.07 as shown on 1099B. Do this if you sell your ESPP within 2 years of grant date.

On the RSU side , lets look at another example

| RSU Events | Amounts |

| Dollar amount of RSU vested | 6000$ |

| Taxes paid when RSU vested | Taxed at normal tax rate deducted at source/paycheck |

| Selling price while selling the vested RSU | 6050$ |

| So according to my broker (on 1099B), my gain | 6050$(6050-0) |

| Actual gain | 50$(6050-6000) |

Usually with RSU’s since you already pay tax on the amount vested, your actual gain is only 6050-6000=50$. Not the 6050 your 1099B tells you.

How do we adjust ESPP cost basis while filing tax returns?

Now that we know why we need to change our cost basis for ESPP and RSU’s in some cases, lets see how to do this. I usually use to file my tax return. I am going to put some screenshots for you to follow step by step on your own:

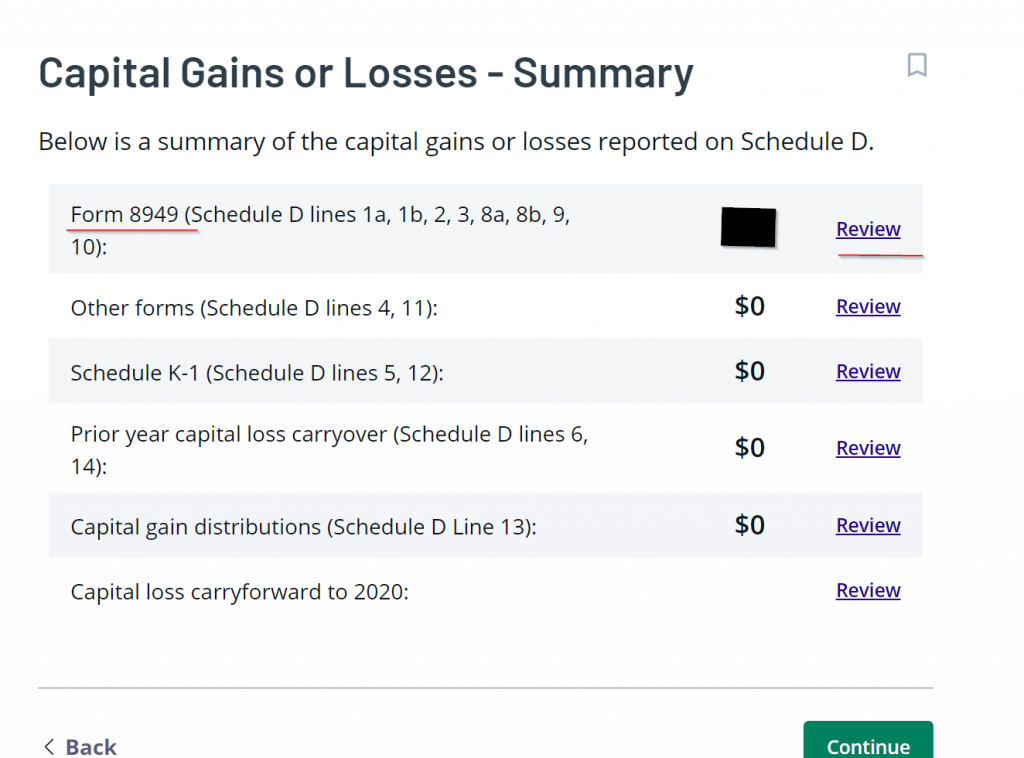

Step1: Complete your basic and life events tab and then go to the Federal tab. Under the federal tab, look at Income–> Capital Gain or loss –> Review:

Next select Form 8949 (Schedule D lines 1a,1b…) and hit review:

This is where you can enter any capital gains or losses, Choose –> Add form 1099-B:

Basically in your tax software you want to go and start entering a 1099-B form under this step.

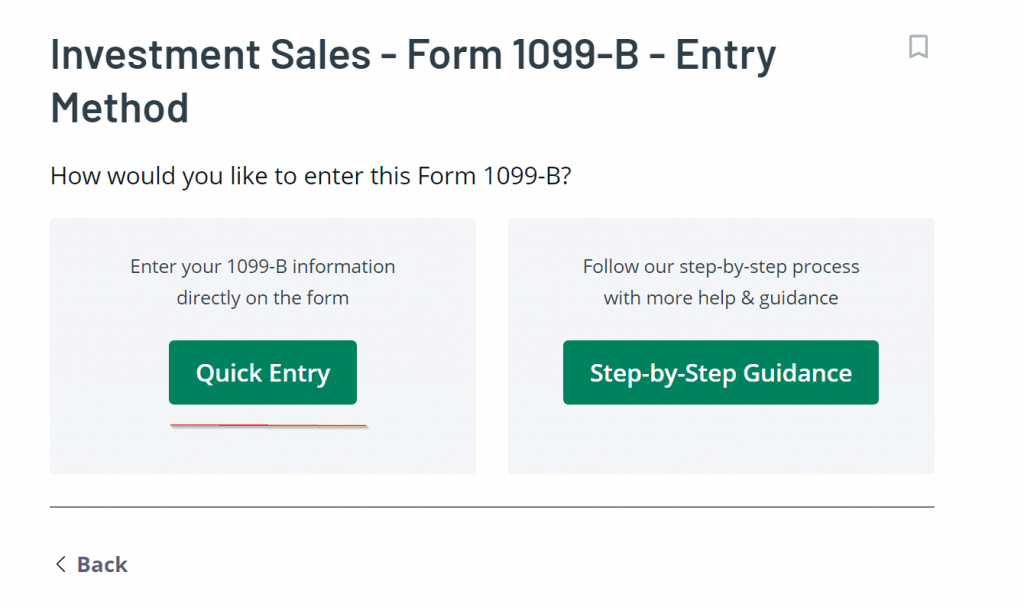

Step 2: Go to quick entry and start:

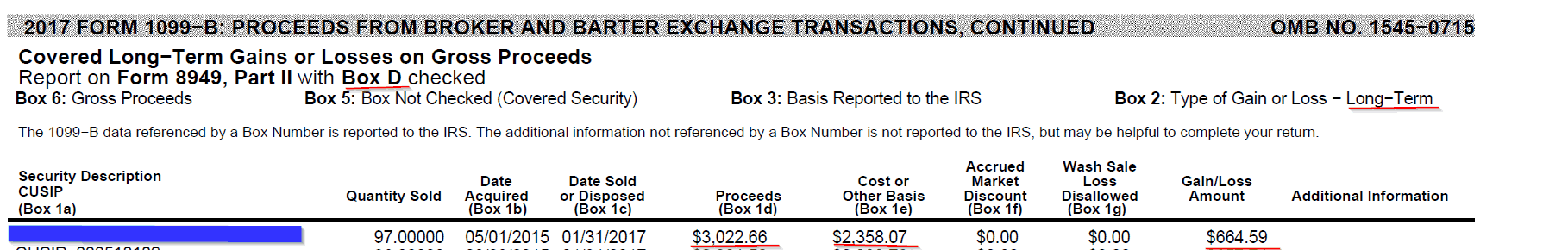

Step 3: Look at your 1099-B from the broker and fill in the normal details. No need to adjust ESPP cost basis yet. Just fill in the details as shown. Here is what my broker showed on 1099-B:

Using the red lines above, I entered the following in my software:

Step 4: Now you may have received a supplement form from your broker. Here is what mine looks like:

The form shows my cost basis with 15% discount and adjustment.

Note: if you did not receive this supplemental form from your broker, you may even look at some documentation your employer sent to you which may have the same info. Alternatively, you can also calculate the 15% discount or whatever discount you get and then in next step enter the amount in the fields shown below:

If original cost of basis is too low, then enter the adjustment amount with negative sign, if cost of basis reported in 1099-B is too high, then enter positive sign. Since our cost of basis entered in 1099-B is lower than the expected, we enter a -ve amount as shown:

As soon as you enter this negative amount and save the form, your tax owed to IRS will go lower or else if you are getting a tax return, it will go higher.

Next just mention this is an ESPP sale.

Select Continue and say Yes to the next question, since we did pay taxes as part of our W2 when we got the ESPP allotted.

Next, you just need to enter the actual adjusted cost basis. This is again present in the supplement form from our broker.

This is all you need to adjust cost basis for espp on your tax return.

How do we adjust RSU cost basis while filing tax returns?

The process is much simple to adjust RSU cost basis. Reason is same, your cost basis is 0 for most RSU’s. So, if you sell them at gain of 200$ (assumption) for total proceeds of 6200$. Your 1099-B might show cost basis of 0 and gain of 6200$. Which is incorrect. Since, you probably already paid some taxes either via paycheck deduction or via sale of some RSU for when RSU vested. So you need to adjust RSU cost basis.

Step 1: Go to the add 1099-B menu option as shown in previous section.

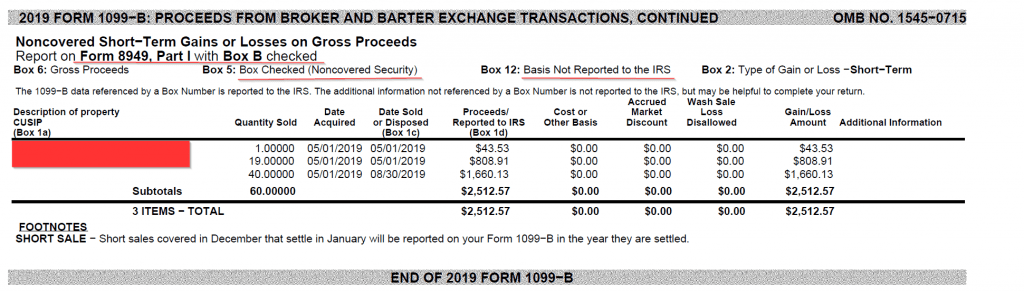

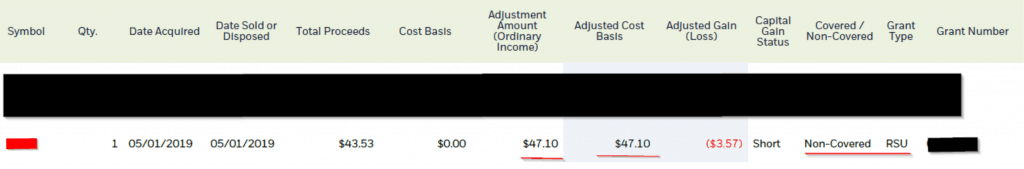

Step 2: Next check out the 1099-B entry for RSU sale from your broker. Here is how mine looks like:

Notice how my cost basis shows up as 0 for all 3 sales I made. First 2 of these were for payment of tax for the whole lot. Also, notice how the second line says the category for 8949 form is Part 1 with Box B checked. Make note of what the Box 12 is and if its a short term or long term transaction. We will use these in next step.

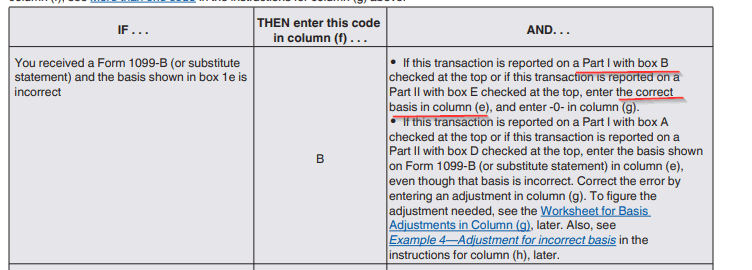

Step 3: Since, this cost basis of 0 is not reported to IRS(Box 12). According to IRS guidelines, you need to enter the actual cost basis in column e directly. No adjustment is required as shown:

Step 4: So, I will look at my supplement from broker and enter the form 8949 as shown below for the first line of 1 stock of RSU shown above.

So, my form 8949 entry on to the ui will be:

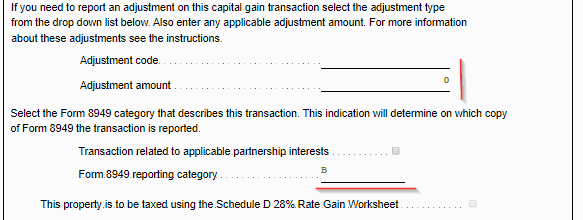

Notice how the adjusted cost basis is directly entered into field 1e. Also, check out how the adjustment section has no entry. This is especially because the BOX 12 mentioned no cost basis was reported to IRS. So it is our job to just directly enter the cost basis. No need for any adjustments. You would still need to make sure the reporting category is still correct in next section of the form(short term B in my case):

This is all you need to make an adjustment to cost basis. Its pretty straight forward, only problem is not a lot of people know about it and they realize it too late. So just knowing about it and glancing through this page will hopefully help you remember to do this when you sell any ESPP or RSU’s when filing tax return.

If you need any more info on things to remember while filing taxes do visit my earlier post here.