Congratulations! you worked hard and made so much that you had to do a backdoor Roth IRA conversion. Now its tax return filing time and you are wondering how do we report backdoor Roth IRA taxes ? This is a vital step which needs to be done correctly to ensure compliance and make sure you are not paying any extra taxes.

This guide will walk you through reporting backdoor Roth IRA taxes using TaxAct software for filing tax return. It only covers the base case where:

- You created/contributed to a traditional IRA before the end of the year. We will characterize this contribution as non-deductible when reporting during tax return time.

- Before end of same year, you completed backdoor Roth IRA strategy by converting the contribution to a Roth IRA.

Doing contribution to traditional IRA and converting it to ROTH in same year helps you make the reporting backdoor Roth IRA taxes very easy. Here the documents you would need to gather from your broker before reporting backdoor Roth IRA taxes:

- Form 5498 which shows your traditional IRA contribution. Your broker sends this to the IRS and a copy to you. This reports that you made some contributions to your IRA account. We need to characterize this as a non-deductible contribution later in TaxAct.

- Form 1099-R, this shows your IRA distributions. Even though you moved money from a traditional IRA to Roth IRA, this still counts as money being withdrawn from your traditional IRA. Usually in case of IRA distributions you are on the hook for taxes and penalties if you are less than 59.5. This is why its important to let IRS know about your withdrawal when filing backdoor Roth IRA taxes.

- Form 5498, another one from your broker mentioning the deposit to your Roth IRA account. This should ideally match the amount in the first 5498 form. Again, because of the multiple 5498 forms your broker reports to the IRS it might seem like you contributed twice the limit into your IRA accounts in a year. its important to make sure we clarify this as well while reporting backdoor Roth IRA taxes.

Steps to report Backdoor ROTH IRA Taxes using TaxAct

- Head over to TaxAct, login –> Open your tax return–> Federal–> income section of your current tax return.

- Click on Review under the Taxable IRA distributions section

- Next click on add 1099-R form in the next page

- Select yourself or your spouse(in whosever name the 1099-R form is). Fill out other radio buttons based on details in your 1099-R form. Also fill out the Broker’s name, address as it shows on the form in the next page on the wizard.

- Next, look at the 1099-R and start filling the fields in TaxAct form accordingly. Make sure to check the checkboxes as well.

- In the next page, since this distribution is not from an HSA account, keep the box unchecked and move forward.

- On the next screen, enter the amount you converted to Roth account. This would change based on the limits every year assuming that you do the maximum amount allowed each year.

- In the next section, assuming you have no other traditional IRA’s with balances or have been doing backdoor Roth in previous years or doing it for the first time and have met the conditions mentioned at beginning of this article. Then you are good to not check this box. This is just saying you do not have any other balance in traditional IRA except for what you converted to Roth. So the pro-rata rule will not apply.

- If you get warnings towards the end of the form, ignore them.

- We are done with entering details from 1099-R. If you head over to Income menu from left pane, you will see that so far we see a 6500$ taxable distribution for our backdoor Roth IRA taxes. This is mostly because we still need to notify the software that this was after tax money and should not be taxed again.

- To do this, from left pane, go to Federal menu option–>Retirement Plan Income–> Click on nondeductible IRA’s form.

- Next just enter the same amount that you converted. Again this will change every year assuming you contribute maximum allowed and whenever government updates it.

- As soon as you enter this amount, you will see the taxable IRA distribution goes back down to 0. In the final form 8606 before submission, in Part 1 it should show your nondeductible traditional IRA contribution.

- Part II of the form should show that you converted the IRA distribution to Roth IRA leaving you with 0 tax amount.

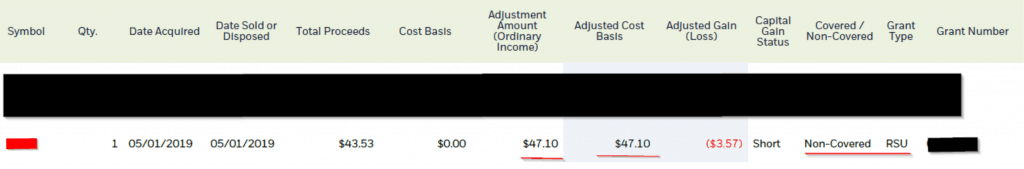

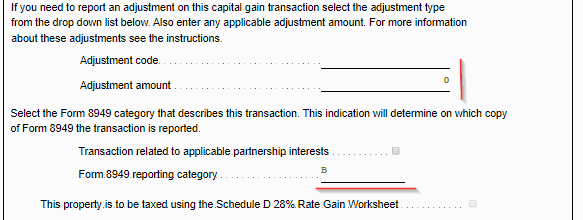

This completes the backdoor Roth IRA tax reporting using TaxAct. If you are interested in knowing about adjusting cost basis for ESPP please check my other post on it.

Disclaimer: The content presented here is solely for entertainment and informational purposes; please do not consider it as professional advice or a substitute for consulting a qualified expert in the relevant field. I am not your fiduciary or an investment advisor or tax advisor.