Dividend Investing for me is a long-term strategy. I like to buy great companies at good value based on historical metrics and dividend safety. Hold them for a long time, re-invest dividends and wait for compounding to do its magic. This quarter though, I decided to focus and keep/move more of my dividend stocks in my and my wife’s Roth accounts. So I did end up selling in small quantities wherever it made sense in my taxable accounts. Ideally I would like to buy and never sell. Here is my Q2 2019 quarterly dividend update and comparison with Q2 2018.

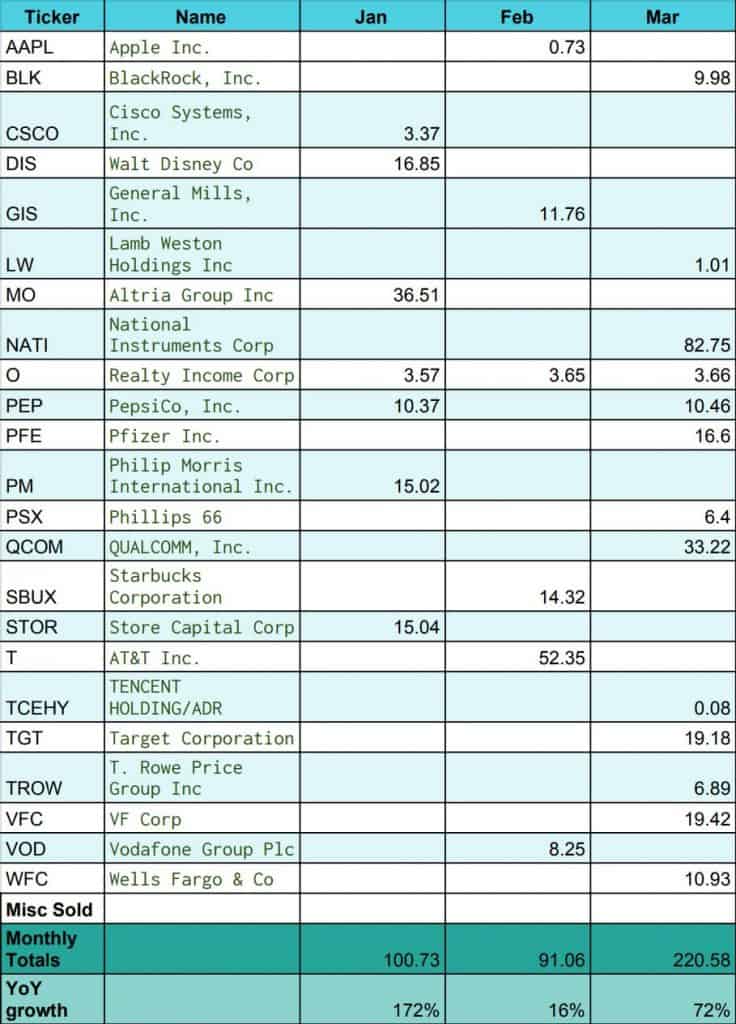

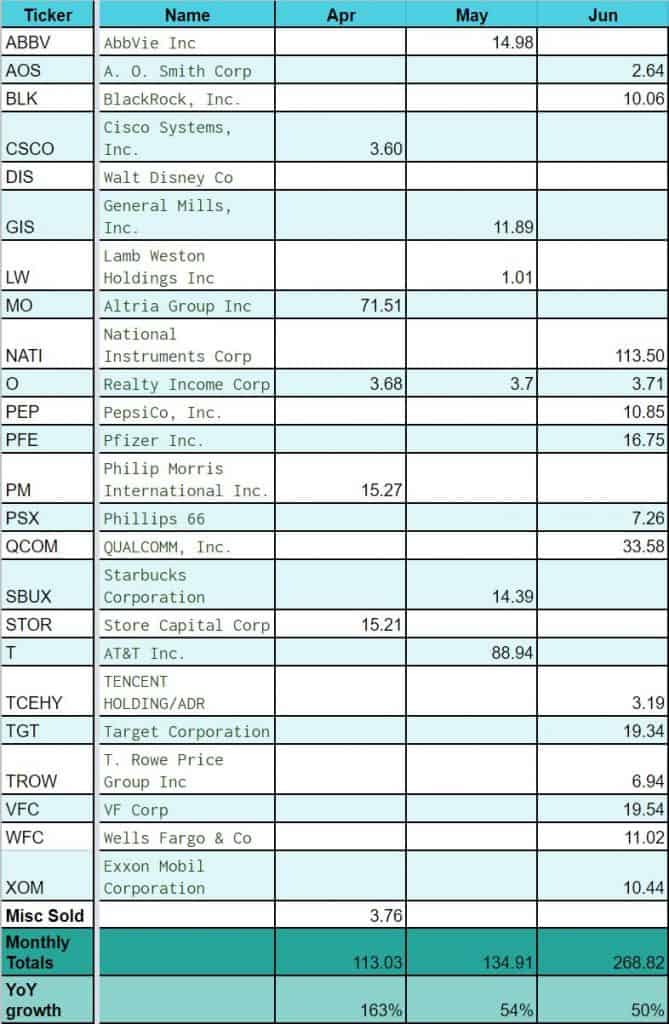

Total: $516.76 for Q2 2019

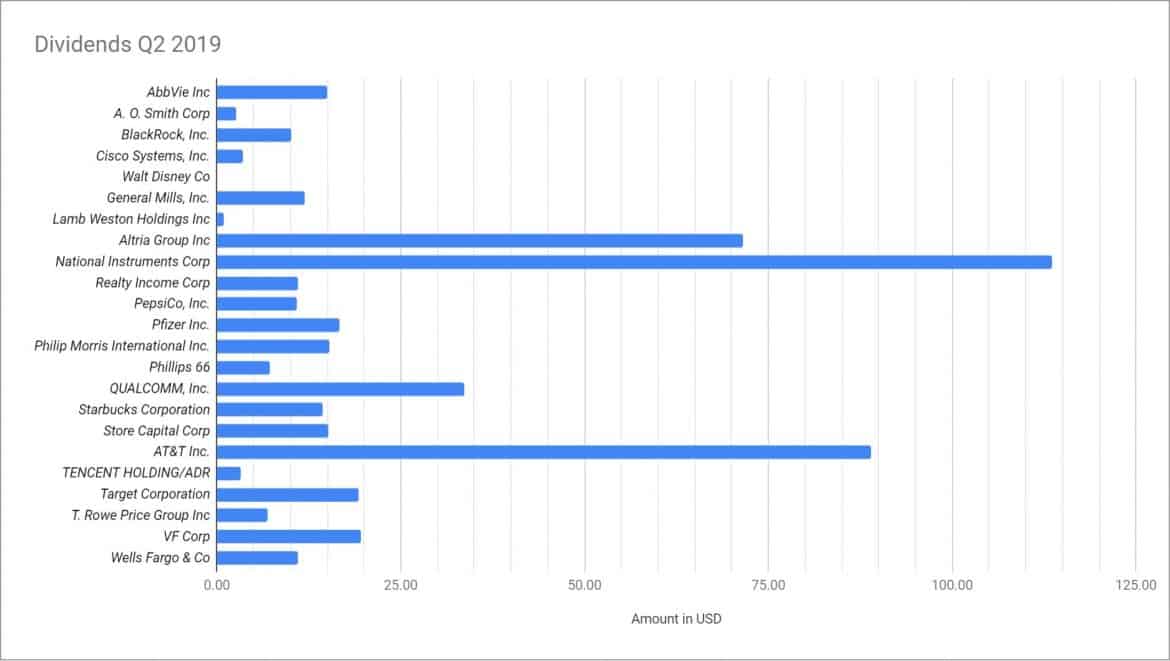

Here is a graphical view of the same data:

My Buys in Q2 2019

- Bought about double my existing position in A.O. Smith(AOS) when 2 firms released short articles and the stock price went down to low 40’s. My original position was in my taxable account. This year I am focused on moving a lot of my taxable dividend positions to Roth accounts. This seemed like a good opportunity to do it.

- Doubled my position in AbbVie Inc. (ABBV ) after they announced they are buying Allergen Plc (AGN) and it fell by 16%. Dividend is still pretty safe. They even announced plan to further focus on dividends. New company will have 18-19 billion in cash flows which is probably the main reason for the deal(diversification of revenue of course). Huge debt now becomes a concern now. I am planning to watch this like a hawk. Need to see debt go down next year as they mentioned in their presentation.

I would expect my Q3 quarterly dividend update to reflect higher dividends with the help of these buys.

My Sells in Q2 2019

- Sold my small position in Coca-Cola Company(KO) at gain from my taxable account, purely to move proceeds to Roth. I might start building a position back in KO but not at these prices.

- Sold my small position in Vodafone Plc(VOD) at loss from my taxable account, again moving proceeds to Roth. Plus this was leading to some dividend being withheld and not being able to re-invest dividends owing to foreign entity in my broker’s account.

- Sold my 1 stock position in Apple Inc.(AAPL) at gain from my taxable account again to move money to Roth. I would like to start a position again in this maybe if it gets back to Dec-Jan 145$ prices.

- Sold some of my position in National Instruments(NATI) from my taxable account. I just sell some of this position when it becomes too large, to reduce risk of too much of 1 stock.

Check out my complete dividend portfolio here.

Click this link for my Q1 2019 dividend update.

Check out my and download/make your own dividend tracking sheet here.

Dividends stocks do come with some risk, but with precautions you can avoid the risky one’s and choose the best dividend paying stocks for your portfolio. I prepared a guide where I discuss some key ratios, fundamentals, some important resources to look at while deciding to buy a dividend stock. Also find out how to get free access to Morningstar, Value Line, workaround paywall behind popular news sites like Seeking Alpha etc. Consider signing up for free instant access to the pdf version of the insights into dividend investing.