How to grow your money and enjoy healthy returns

Curious about selling covered calls for income ? Not sure what are options, what is a call and where to get started? In this article we will discuss what are options contract, what is a covered call and how to sell covered calls for income. We will also look at risks associated with such a strategy.

What are Options?

An option is a contract between 2 parties. There are 2 types of options contract:

Call Options

Buyer of an option gets the right (not obligation) to buy the stock at a particular price (strike price) by a date(expiry date). On opposite side of the trade, seller of call option has an obligation to sell the stock at strike price by that date.

Let’s say stock XYZ is trading at 50$. Now, call buyer might expect the stock to go to 55$. But, he doesn’t want to pay 100*50(5000$) to own stock and wait to get to 55$. So, they will look for a call option on the stock. Let’s say its for 52 strike price for .50 a contract (each contract is 100 shares), 1 month expiry into future. So, they will end up paying about 100*.50 = 50$ for the option on stock XYZ. Option buyer was able to buy the right to buy these 100 shares of XYZ for 50$ in commission/premium. Commission goes to the seller of the option. 2 things can happen till expiry:

- If at any time until expiry, price of XYZ reaches 52$ (strike price), buyer will be thinking his bet is turning true. When it reaches 52.50 (his commission plus strike price) then any price above it is pure profit on the stock. So, buyer can exercise their right to buy XYZ from seller at 52*100= 5200. Sell it all to book their profit. In such situations, contract is In The Money (ITM).

- Price stays below 52$. In such cases, buyer still has the right to buy the sellers stock for 52*100=5200$. But, if they can get it for 51.99*100 = 5199, why would they exercise their call option? Thus, the contract option expires worthless and is Out of The Money (OTM).

Put Options

Gives the buyer of the option contract right (but not obligation) to “sell” a stock at a specified price(strike price) within a fixed period of time(expiry date). On the other side of this trade, the put seller takes on the obligation to buy that stock at the strike price. The put seller also gets some commission to take on the obligation for the put option. I won’t go into more details with an example since we only need to learn about call options for covered call.

What is a Covered Call?

Covered call is just a simple call option in which the seller already owns the underlying stock. As the call option seller has the obligation to sell the stock, the seller has two options: either sell the call option first and think about buying the stock later when the buyer of the call exercises their right to buy the stock at strike price(naked call). Or else, they can first buy or have an existing position of a stock and then sell the call option based on that. In this case, they already have covered the part of them being able to sell the stock at strike price if the buyer exercises their right.

Advantages of Covered Calls

- Income! You get to keep the premium/commission from each covered call you sell. It also helps you reduce your cost basis. You can sell them every month or 45 days to boost your annual returns.

- Exiting a stock position. Lets say, you have 100 shares of stock ABC and its currently trading at 39. You want to exit out at 41.50. You can look for a call around that strike price. This way, you make some commission by selling the call plus also get exactly 41.50*100 $ for your stock. Obviously for this to happen your stock needs to go at that price and call exercised. If that doesn’t happen you can always sell another call and collect the commissions waiting for it to reach that strike price.

Disadvantages of Covered Calls

- You cap your profit potential. Speaking of the previous example, if the stock goes to 45 by expiry, you still get 41.50 for your stock and the call buyer will probably buy your stocks and make profit on the difference.

- During the period between your selling of covered call and its expiry, you cannot trade away the underlying stock. Since the call buyer has the right to those stocks, they can buy it form you anytime before expiry.

- You might end up selling a stock you are long on.

Selling Covered Calls for Income

Now let me walk you through the process of selling covered calls for income on an existing stock position via Schwab.

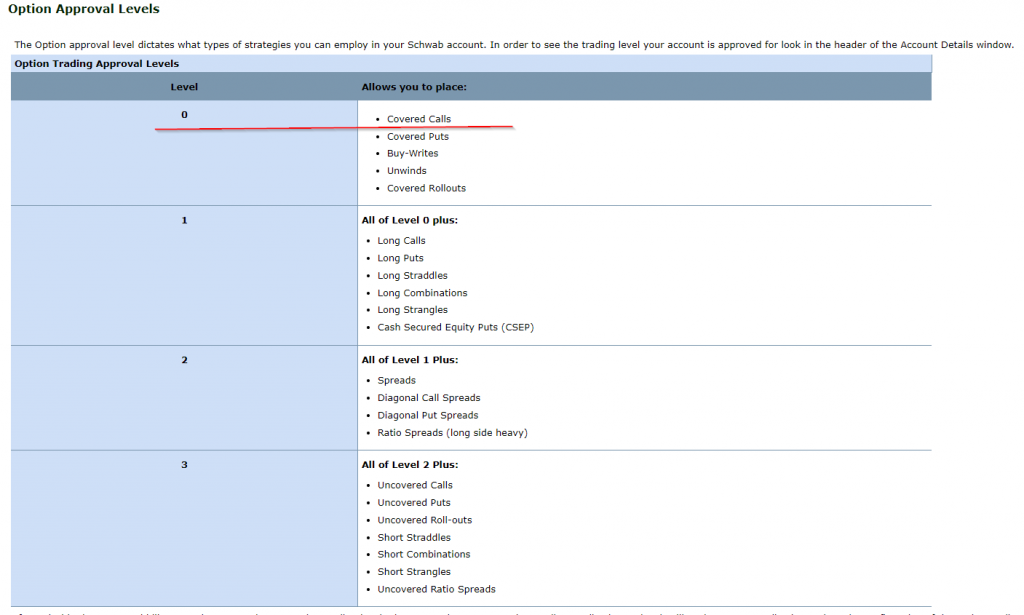

- Make sure you can trade options on your broker’s platform. Different brokers have different ways to approve you. Schwab’s application can be found here. Each broker has levels of access that comes with options. First level is enough at most brokers for selling covered calls for income. Here is an explainer on Schwab’s levels.

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income.

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income. - Next, search for the stock for which you are selling covered calls for income. Make sure you have at least 100 shares of that stock within one account. You should also come out positive on your cost basis if your stock gets sold at strike price. We do not want to end up making a loss on overall cost basis. For me, this stock was Kontoor Brands (KTB), find it and hit trade:

Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option.

Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option. - Next, we need to figure out what expiry date options do we want to sell covered calls for. For this we need to look at the options chain for this stock. Most brokers will provide you the chain right there when making the trade. Click the link icon and then go to options chain:

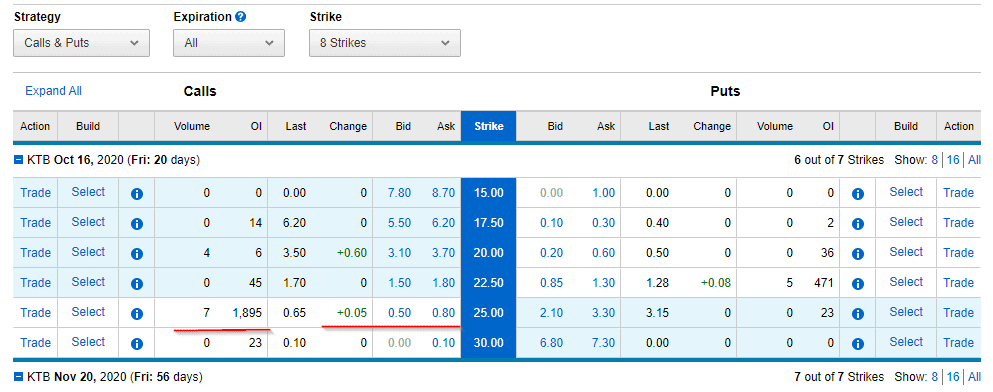

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls.

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls. - Bid is maximum price any call buyer is willing to pay at that time. Ask is the minimum price a call seller will accept at that time. Volume is the number of options contracts bought or sold any day. OI (open interest) refers to number of open contracts.

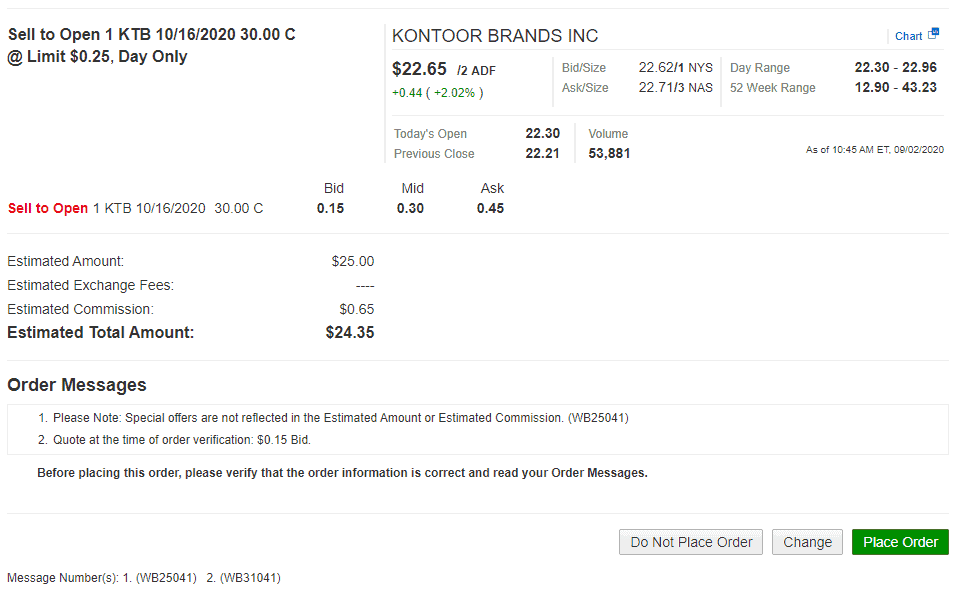

- Eventually, I was able to find a 30$ strike price call contract with expiry date of 16th October 2020. As you can see below, the bid was about .15 cents and ask was about .45 cents per contract. So I entered a limit price order of about .25 cents for 1 contract.

What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers.

What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers. - The action will always be sell to open. It means you are selling a call to open a contract position for the underlying stock.

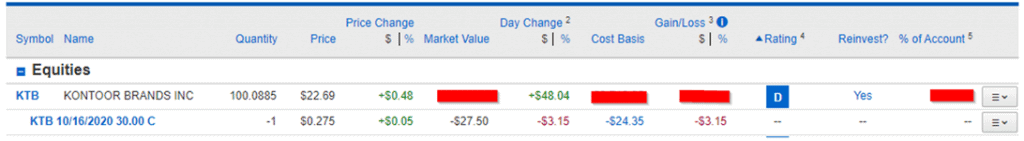

Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.

Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.  That’s it!

That’s it!

Risks when selling covered calls for income

- Most of us dividend investors are long on our stocks. Main aim is to hold stocks, get dividends and let compounding do its magic. Selling covered calls for income makes you technically short on the stock. You are hoping for your stock to stay down in price so it doesn’t get called and you get the dividend on the side.

- You are literally betting here. Betting on where the price of the stock will be by expiry date. As we all know this can go either way. So, be ready to part with your stock position if your stock reaches the strike price.

- Be aware of dividends and earnings dates. Sometimes, if a stock is paying dividends and the current stock price plus dividends will allow the buyer of your call to make even a few cents (even if the current stock price is lower than strike price). Buyer might call your stock and sell those shares. Similarly, earnings announcement leads to some volatility for most stocks. So, its possible your stock crosses the strike price and gets called by the buyer and you loose those shares and some potential extra profit.

- Figuring out what stocks to use for selling covered calls for income and at what price and expiry date requires research in itself. You need to make sure the options for a stock have enough volume, open interest and you make a good commission when selling covered call for it. Usually, options near expiry date and with higher difference in current price and strike price will give very less commissions. So, you need to maintain a balance between commission and strike price and expiry dates. Otherwise, you may end up with a call options trade that doesn’t get filled. This is beyond the scope of this post, but you can check more about it here.

Conclusion

My strategy for all stocks I own is to be long on them. However, selling a covered call allows me to make some extra income. Although, I could be selling my shares at strike price. I could be generating tax events. I could potentially end up selling my stocks at less than cost basis generating loss. So, my plan is to sell covered calls for income at very high strike price. Its possible that I will get very less commissions because strike price is high, but I am interested in making sure my stock doesn’t get assigned/called away by call option buyer. I also want to make sure the strike price will always be greater than the cost basis of the stock. Plus, I want to do this in my IRA account to not create any taxable events. Let me know in comments about your thoughts on this.

Disclaimer: The above are just my opinions expressed in the article. I am not your fiduciary or an investment advisor. Do not consider this as investment advice to you. This article is just for informational and entertainment purposes. Options are a risky product so do your due diligence before buying or selling any options.

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income.

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income. Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option.

Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option.

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls.

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls. What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers.

What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers. Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.

Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.  That’s it!

That’s it!

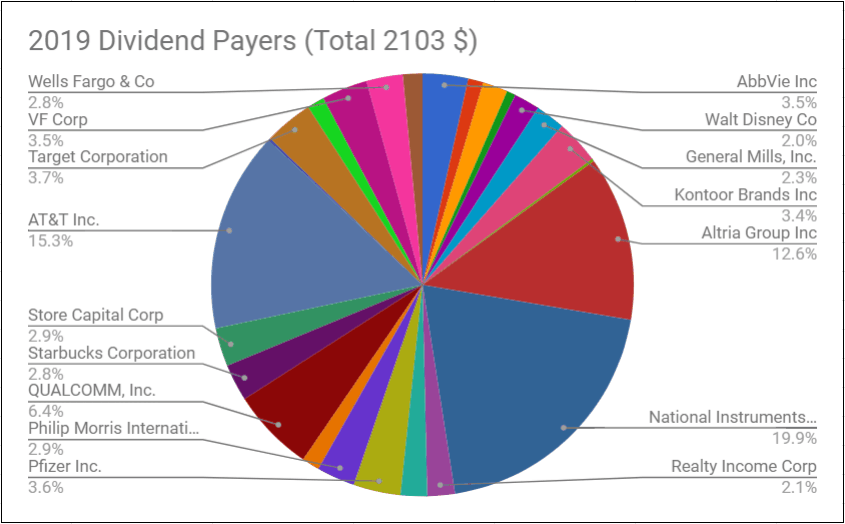

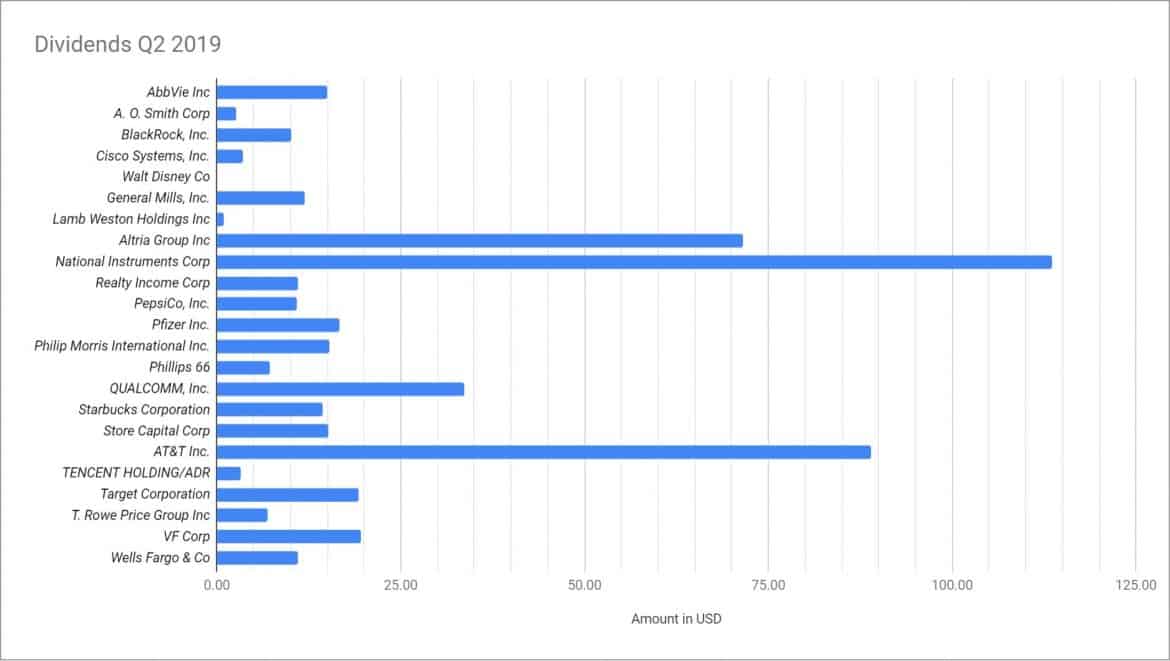

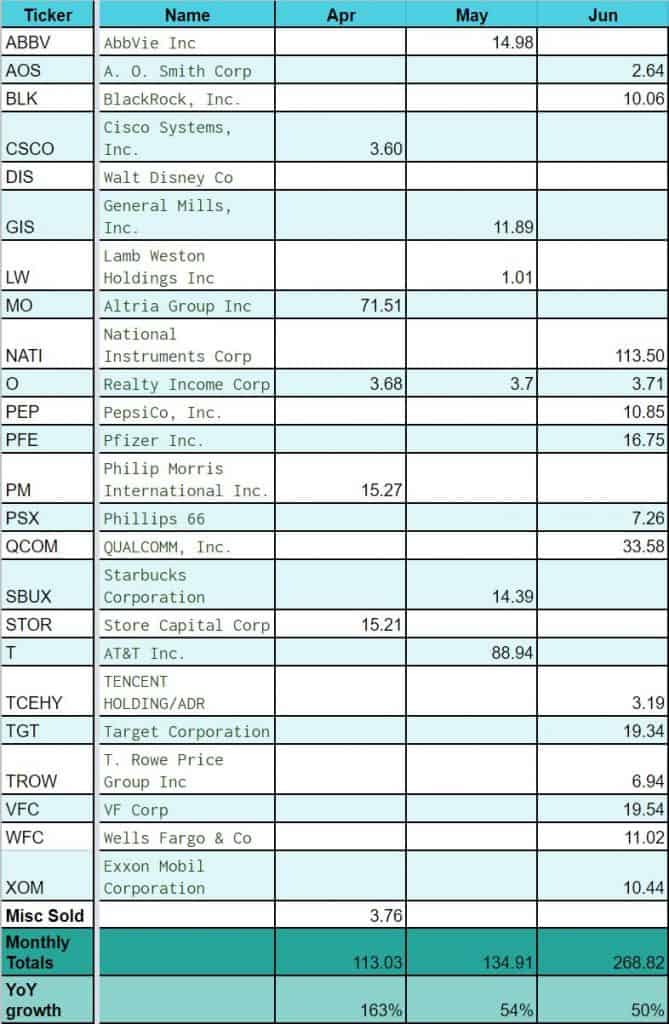

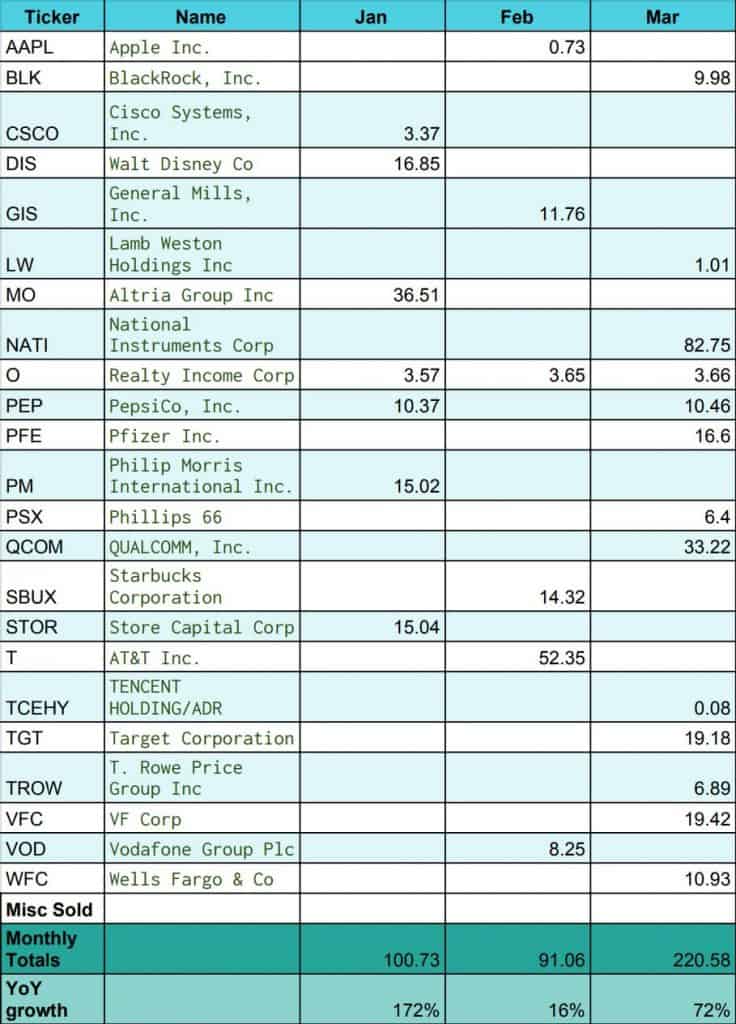

Check out my and download/make your own

Check out my and download/make your own