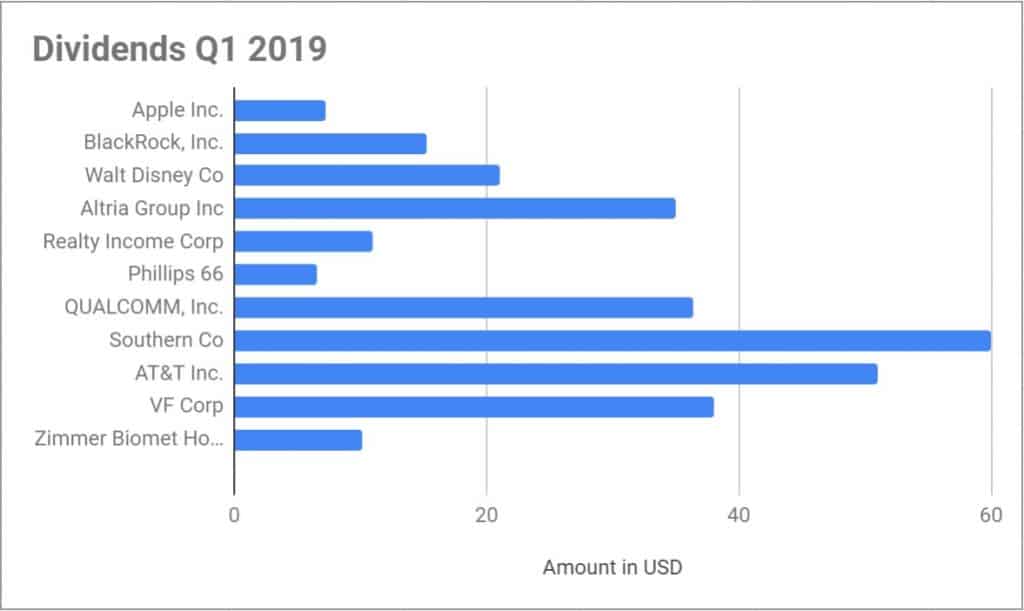

I have been tracking my Dividend Growth Investing (DGI) portfolio for 3 years now & publishing since 2. I check up on my portfolio once every quarter. I wanted to present it in a way that is easy to understand and helps look at the benefits of dividend investing over the long term. Presenting a timeline of dividends my DGI portfolio kicks every quarter.

ANNUAL DIVIDEND INCOME UPDATE 2024

ANNUAL DIVIDEND INCOME UPDATE 2023

ANNUAL DIVIDEND INCOME UPDATE 2022

Annual Dividend Income Update 2021

Annual Dividend Income Update 2020

Quarterly Dividend Update: Q3 2020

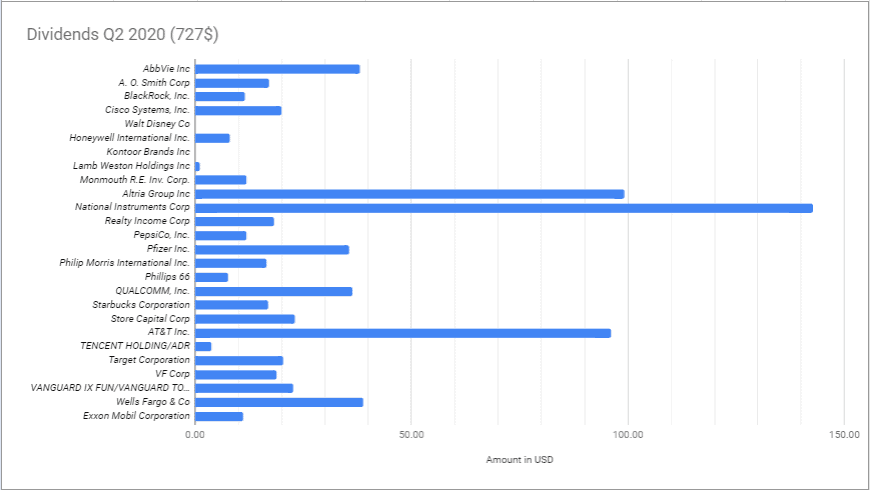

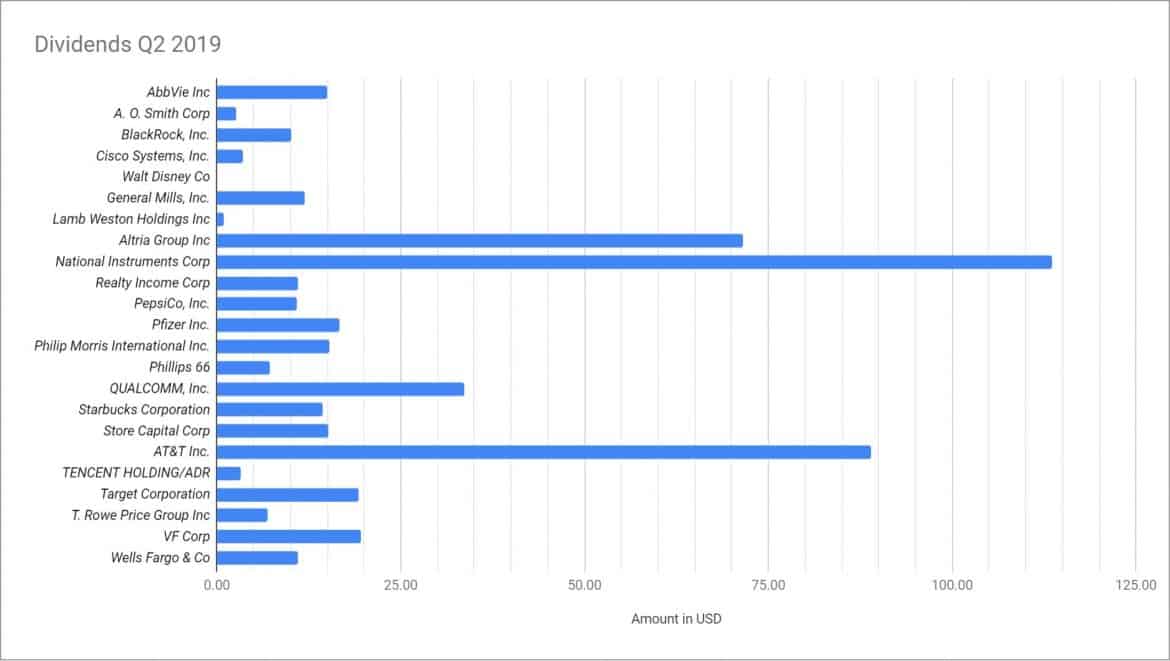

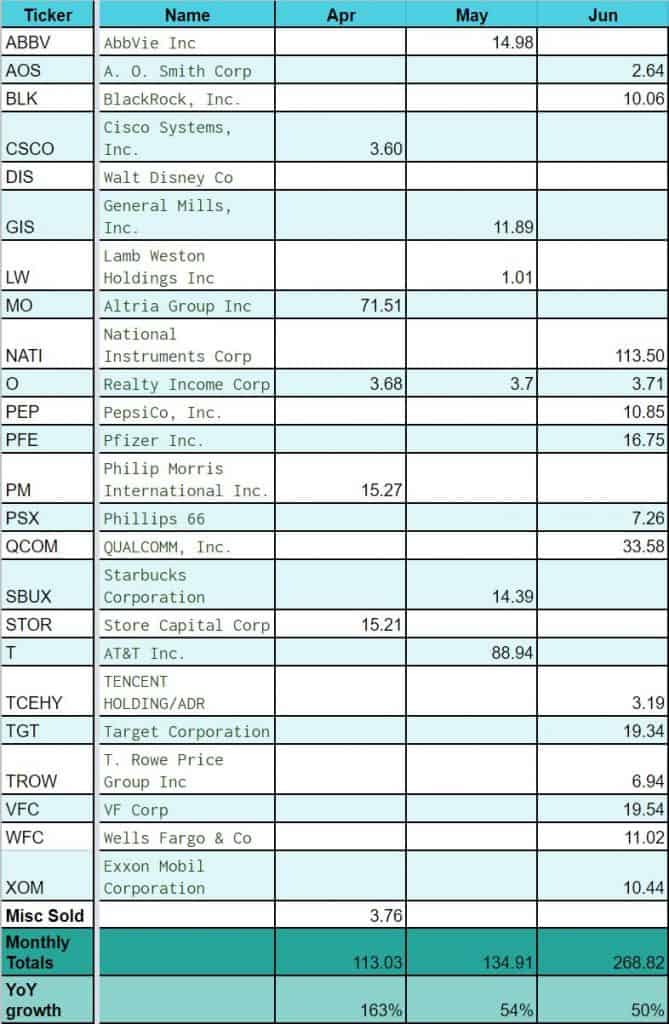

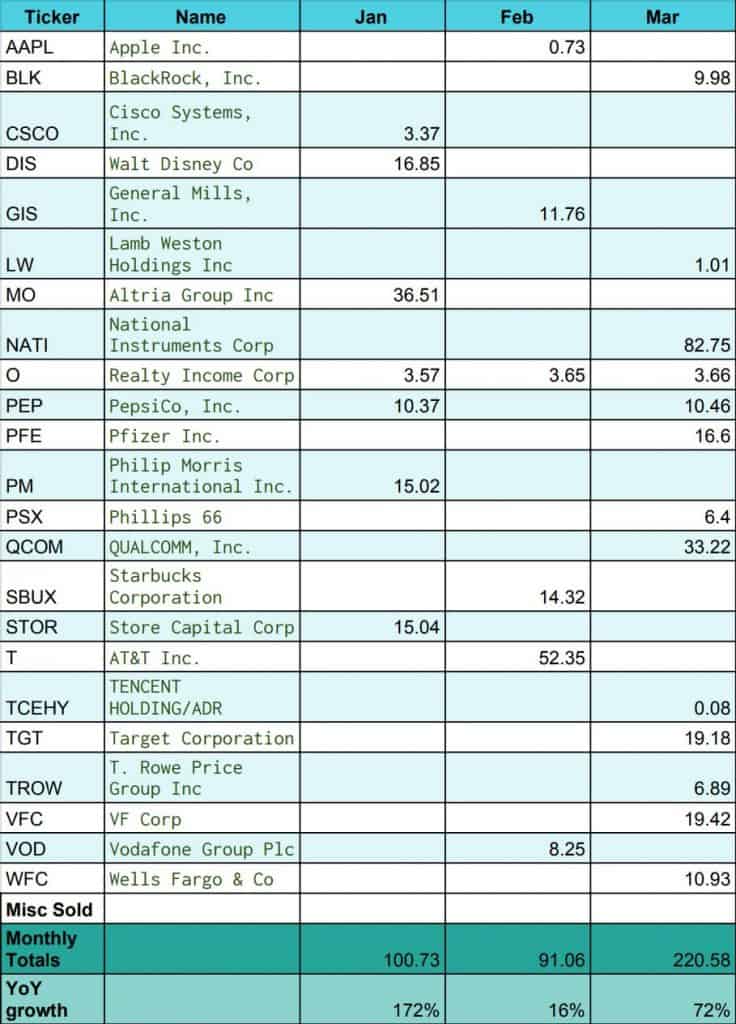

Quarterly Dividend Update: Q2 2020

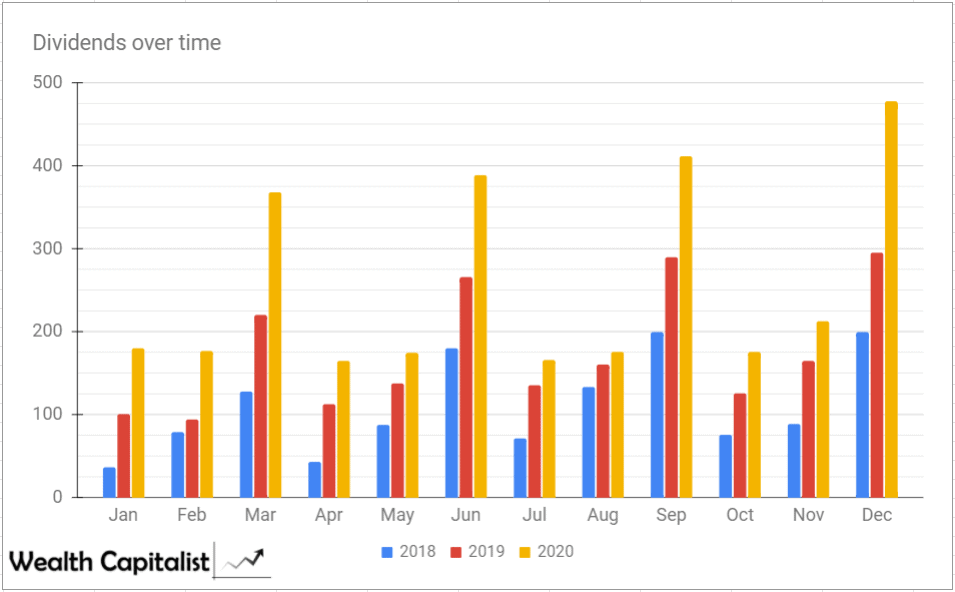

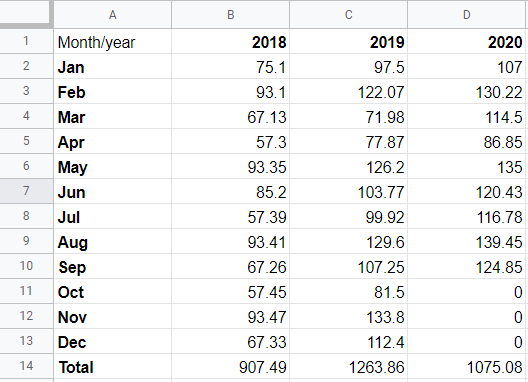

Feel free to click on any event on the timeline to read more details about that quarter. I also created a month over month dividends over time graph. It helps me visualize compounding effect of my DGI portfolio. You can see how dividends have increased every month over month, every year like clockwork!

Here is the latest sector breakdown of my DGI portfolio holdings at end of 2020:

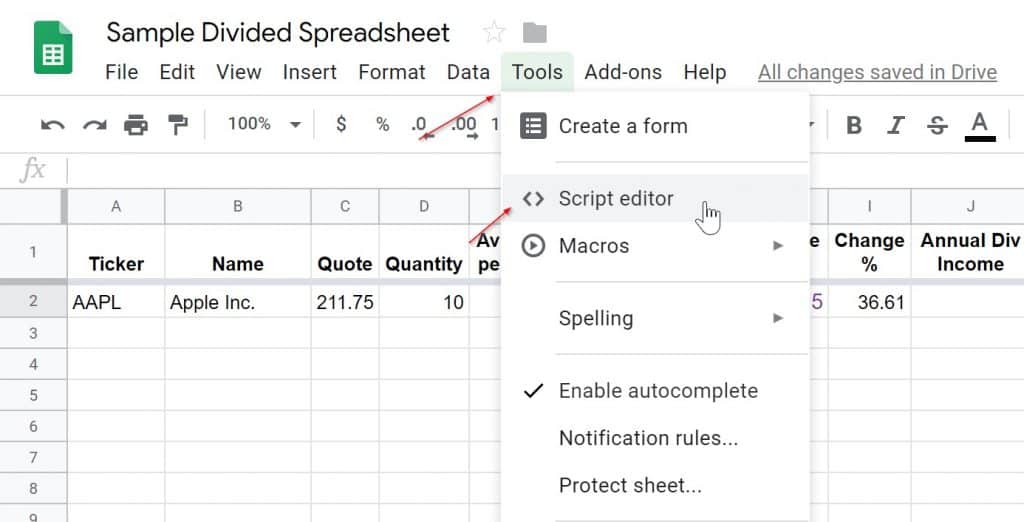

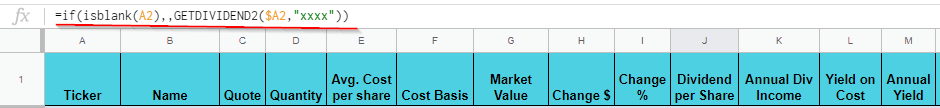

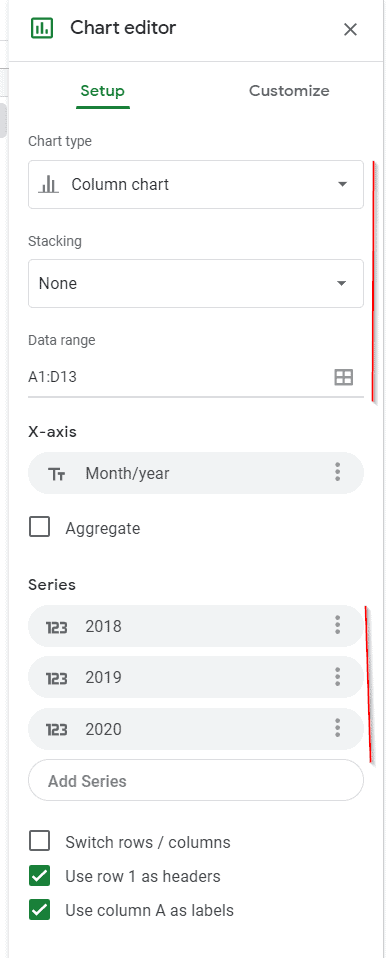

Check out how you can create your own dividend tracking google sheet with graphs and charts shown here.

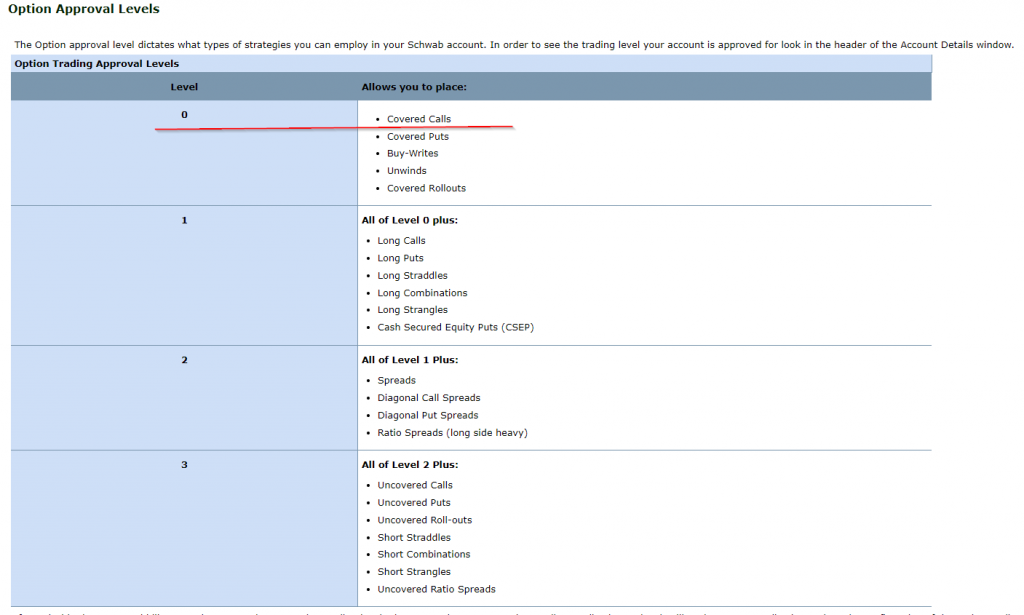

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income.

Depending on your broker, it will take 1-3 business days for them to approve you for selling covered calls for income. Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option.

Depending on if you are enabled for options trading, you will see options under strategy. We want to choose Call here under strategy. So we are saying I want to trade (buy or sell) a call option.

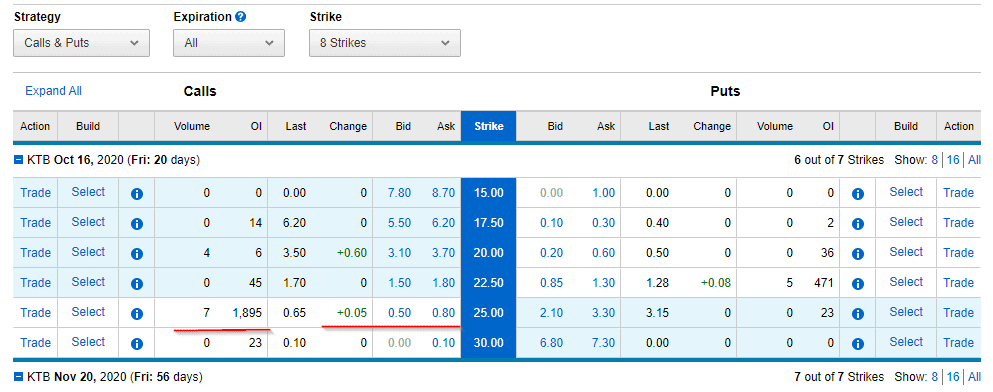

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls.

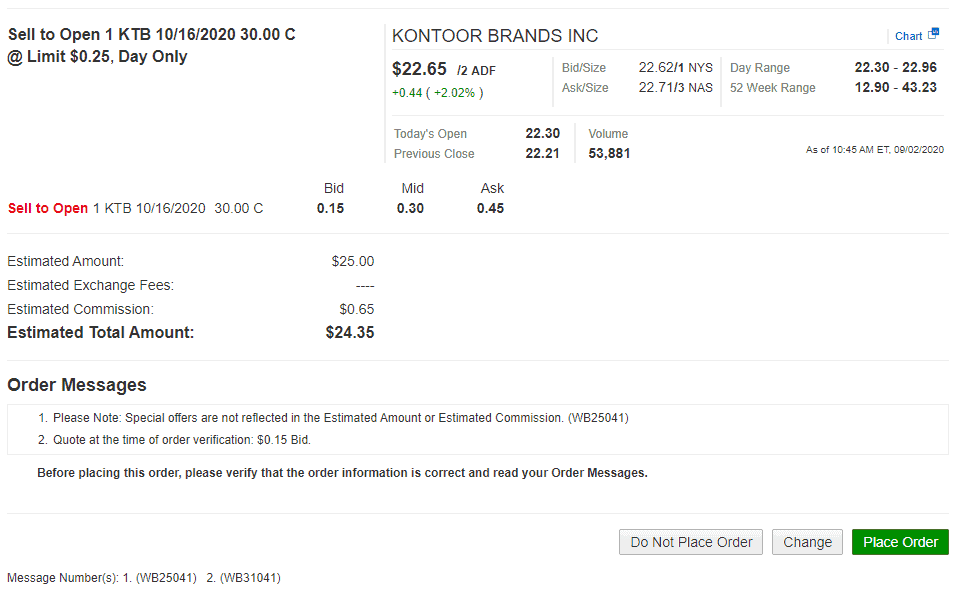

This is from a very recent screenshot, so numbers might not be accurate. Stock price was around 23$ at this time. What you see on left of the strike column are details for selling covered calls. What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers.

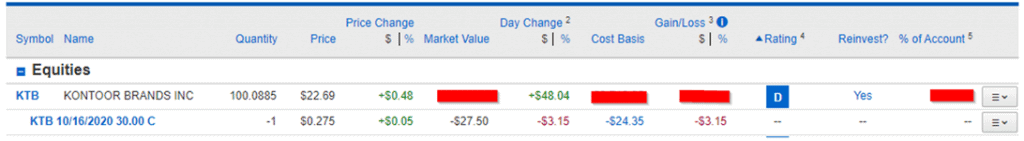

What this means is, if someone enters a contract to buy a call for KTB stock for .25 cents or higher with expiry of 16th October, my contract will get sold. The buyer will then have right to buy my 100 shares of KTB at pre-agreed strike price of 30$ anytime by 16th October. For that right, I get .25*100 = 25 $ commission. This part of selling covered calls for income matters to us, the call sellers. Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.

Once, you place the order and it gets filled, then you will see the commission in your account immediately. The contract gets assigned against your existing 100 shares.  That’s it!

That’s it!