articles related to dividend based investing

Dividend Investing for me is a long-term strategy. I like to buy great companies at good value based on historical metrics and dividend safety. Hold them for a long time, re-invest dividends and wait for compounding to do its magic. In contrast with Q1, Q2 2020 has been great for investors. From the bottom in March, the indexes almost rebounded back to their pre-Covid levels. I cannot and won’t even try to figure out what happens next. All I am planning to do is to keep buying stocks and ETF’s. Here is my Q2 2020 quarterly dividend update:

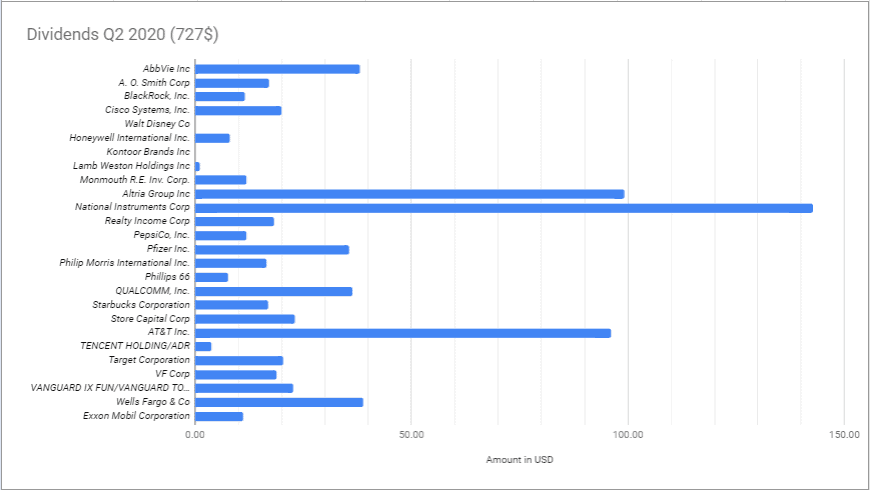

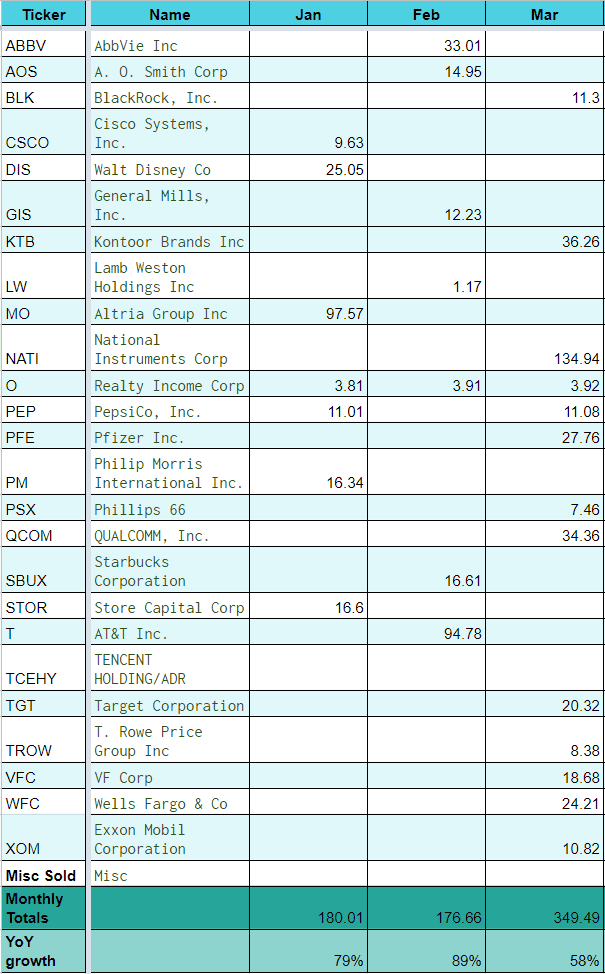

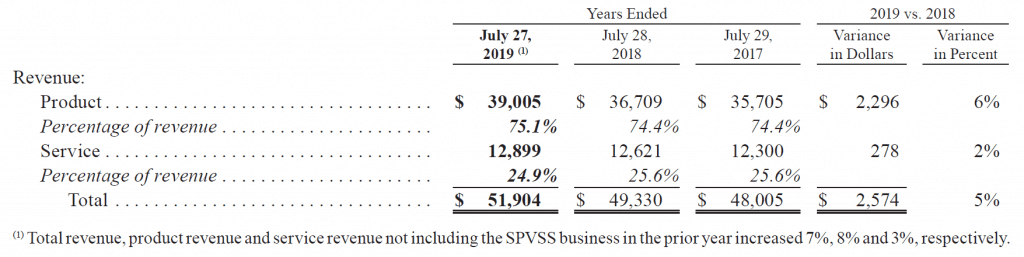

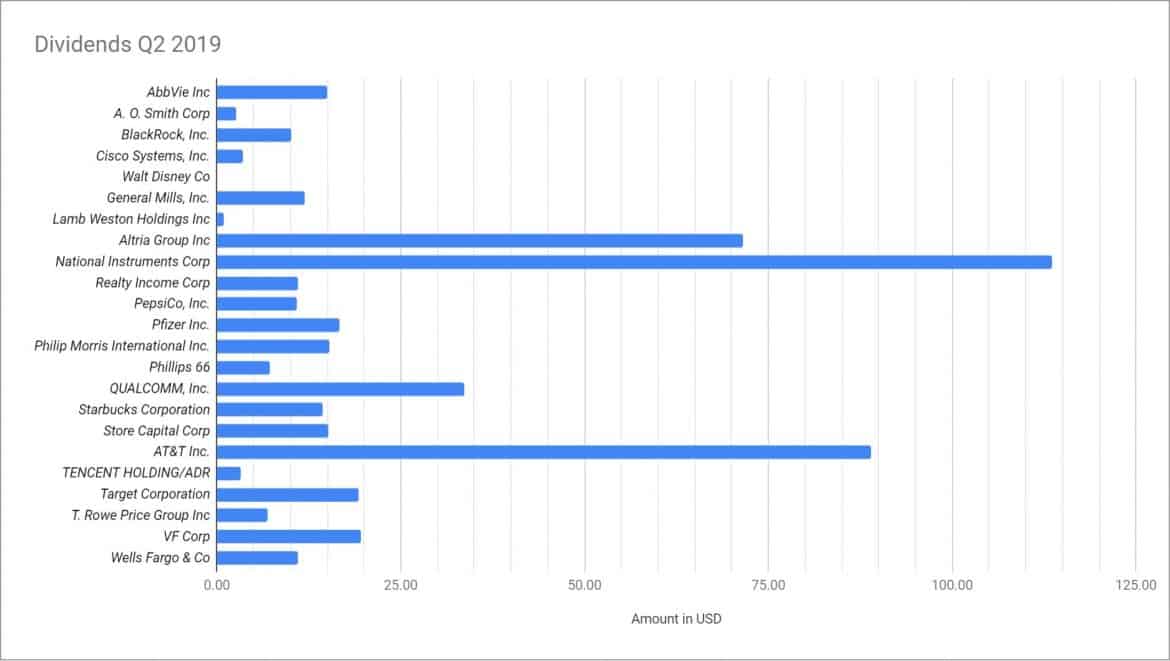

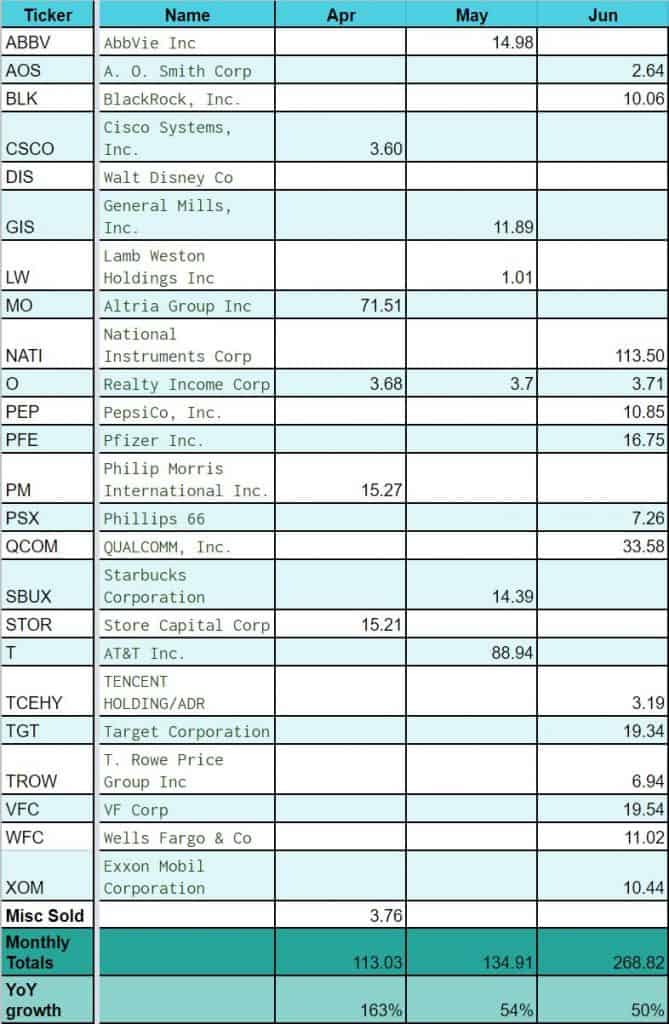

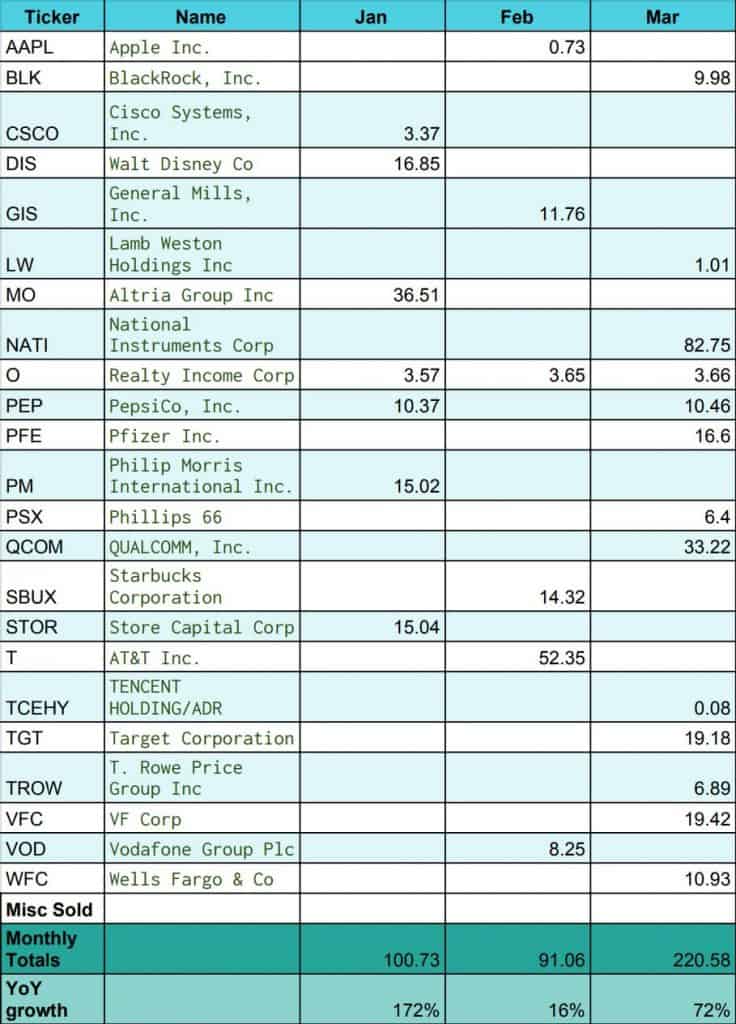

Total: $727 for Q2 2020 (up 40% from Q2 2019 & up 2% from Q1 2020 )

Here is a graphical view of the same data:

Check out my and download/make your own dividend tracking sheet here and create awesome graphs as above for free.

My Buys in Q2 2020

So, the volatile market has offered some great opportunities! Frankly speaking I was not a 100% prepared to think about what to buy. I definitely had some stocks in my watch list, but I had not looked at them in a long time. Plus I got busy with a lot of work and so did not get much time to research any new stocks. So, at first I decided to add to my existing open positions which I thought were at attractive valuation. I also added a new stock to my portfolio.

- Added to position in A.O. Smith (AOS) in 30’s and low 40’s. They have had issues with revenue drop off in China since 2019. However, I like the safety of their dividend and their expansion in India. Eventually, they should get back to growth in revenues.

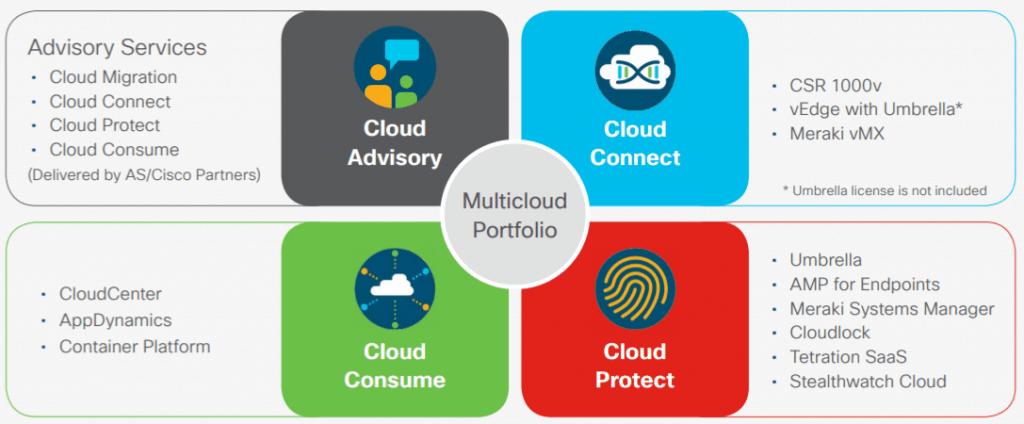

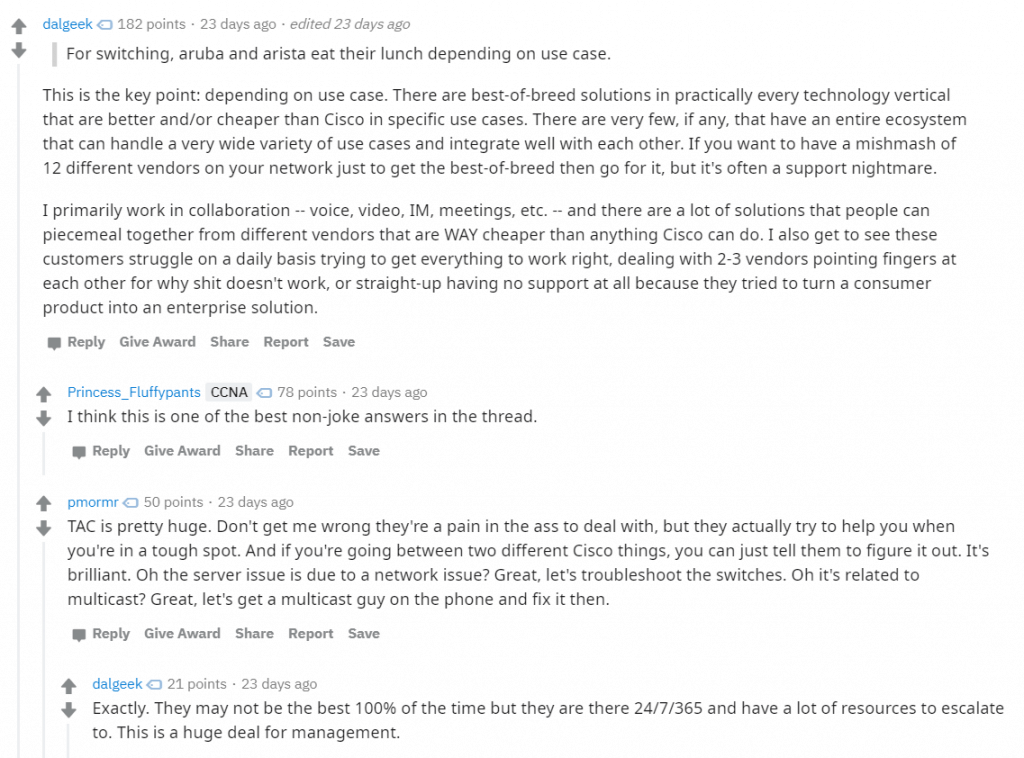

- Added to my Cisco Systems Inc. (CSCO) position. You can read more about my complete research on Cisco Systems here.

- I added to my position in Kontoor Brands (KTB). This is one of few stocks that is still around its March lows. They ended up having to cut their dividend. Because of this a lot of dividend based funds had to force sell this stock putting pressure on their stock price. This is still a long term hold for me. Full research here.

- Started a position in Monmouth Real Estate Corp. (MNR). This is a REIT that is focused on industrial properties. They only have investment grade clients like FDX, AMZN, KO, HD, RTX etc. They even collected 98-99% rent during the last 3 months. Bought some at starting yields of 6.9 % and then added a bit more during the quarter.

- I also added to my position in Starbucks (SBUX) in my Roth after selling some of my position form a taxable account.

- Added to my position in Wells Fargo (WFC) in 20 & 30’s.

- I used to have a small position outside my 401K in VTI before the crisis. However, last 3 months saw stocks go down so fast and come back up very fast. Working a full time job and researching what individual stocks to buy was looking difficult. I was just not finding enough time. So, I added to my existing positions which I had looked at before and opened new positions in MNR and HON only. But, throughout the crisis, I added big to my VTI position. No need to think/research much before adding to it. I am planning to continue adding to it every month. Since it will become a big part in my portfolio with all the buys, I also plan to add it to my statistics for every quarter.

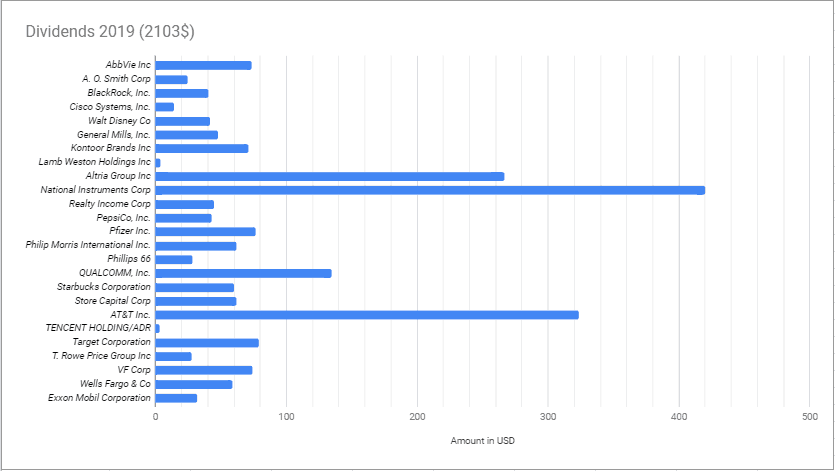

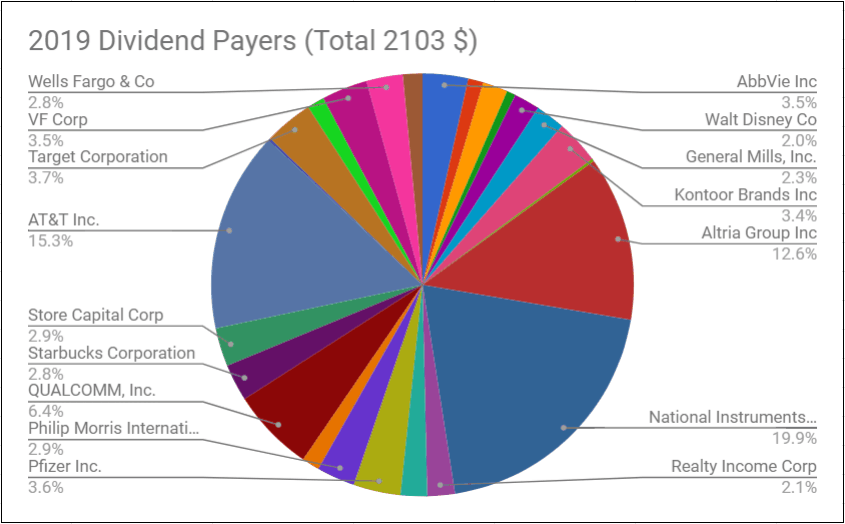

I am projecting an increase to 2900$ in forward annual dividends as compared to 2103$ I made in 2019!

My Sells in Q2 2020

- I sold my Starbucks SBUX position in taxable account and bought it in my Roth.

- Sold my small CSCO position in taxable account and bought some in my Roth.

- I had a small position in Trow Price (TROW). I decided to sell that from my taxable account and will focus more on my Blackrock Inc. (BLK) position.

I did have Kontoor Brands (KTB) and Disney(DIS) cut dividends in Q2 2020 to preserve cash. Both business were challenged by the virus and seems like a relevant action to take. I decided to not cut them in my portfolio as I still think they will bounce back from this over the long term.

Thoughts about Q3 2020

Upcoming quarter will have Q2 earnings from most companies in my portfolio. We will get to know more impact of the virus on companies. In the last week, we have had a steep rise in cases in many US states. Some states have hit a pause on reopening and some brought few restrictions back. It will be interesting to see if states want to close economies again or just carry on and not go back to the lock down people experienced in last 3 months. I know one thing for sure: I will keep buying stocks and ETF’s during this quarter.

Check out my complete dividend portfolio here.

Click this link for my 2019 Annual dividend income update.

Dividends stocks do come with some risk, but with precautions you can avoid the risky one’s and choose the best dividend paying/growing stocks for your portfolio. I prepared a guide where I discuss some key ratios, fundamentals, some important resources to look at while deciding to buy a dividend stock. Also find out how to get free access to Morningstar, Value Line, workaround paywall behind popular news sites like Seeking Alpha etc. Consider signing up for free instant access to the pdf version of the insights into dividend investing.

Check out my and download/make your own

Check out my and download/make your own

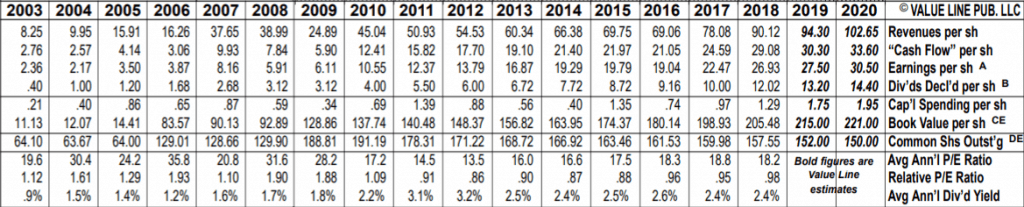

their endowment funds to BlackRock to manage it and grow. World’s biggest companies ask Blackrock to manage their pensions funds and grow them. Some of the world’s biggest wealth funds, tax exempt institutions, charities etc. engage in services of BlackRock to manage their money. Blackrock in turn charges them fees to do it. Apart from this, they also own the iShares brand of etfs. If you want to do index investing but want more liquidity in selling and buying your shares, you would look towards ETFs. ETFs like IEMG (emerging markets), ITOT(Total US stock market), IVV(US S&P 500) are products of the Blackrock family. These cost almost nothing to make, all they do is package different individual stocks and sell them together as 1 security and collect some fees every year on it. They already have country specific, industry specific, dividends specific ETFs. ETFs inherently reduce risk since it allows you to diversify. and provide liquidity. They are very popular among all type of investors retail/institutional or individual. Blackrock is the largest ETF provider in the world!

their endowment funds to BlackRock to manage it and grow. World’s biggest companies ask Blackrock to manage their pensions funds and grow them. Some of the world’s biggest wealth funds, tax exempt institutions, charities etc. engage in services of BlackRock to manage their money. Blackrock in turn charges them fees to do it. Apart from this, they also own the iShares brand of etfs. If you want to do index investing but want more liquidity in selling and buying your shares, you would look towards ETFs. ETFs like IEMG (emerging markets), ITOT(Total US stock market), IVV(US S&P 500) are products of the Blackrock family. These cost almost nothing to make, all they do is package different individual stocks and sell them together as 1 security and collect some fees every year on it. They already have country specific, industry specific, dividends specific ETFs. ETFs inherently reduce risk since it allows you to diversify. and provide liquidity. They are very popular among all type of investors retail/institutional or individual. Blackrock is the largest ETF provider in the world!