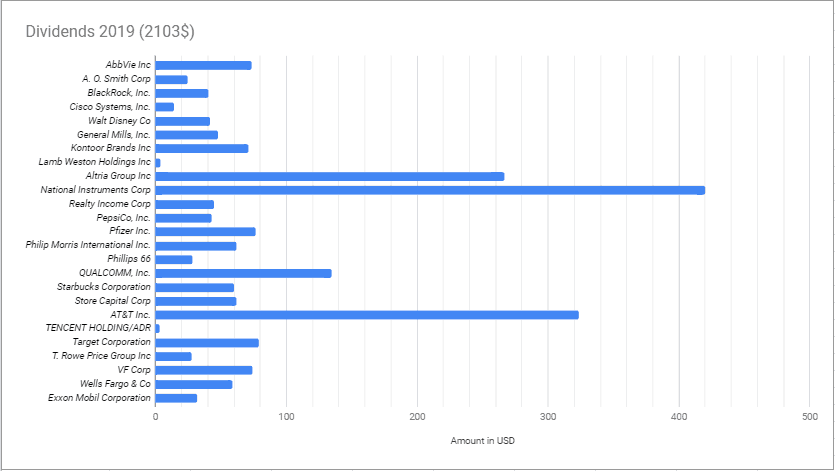

Dividend investing for me is a long-term strategy. I like to buy great companies at good value based on historical metrics, dividend safety & future prospects. Hold them for a long time, re-invest dividends and wait for compounding to do its magic. In Q4 of 2019 I was able to add to my CSCO & PFE positions. Here is my dividend income for all of 2019:

Total: $2103.36 in dividend income for 2019 (up 37% from 2018 )

Here is a graphical view of the same data:

Check out my and download/make your own dividend tracking sheet here and create awesome graphs as above for free.

Check out my and download/make your own dividend tracking sheet here and create awesome graphs as above for free.

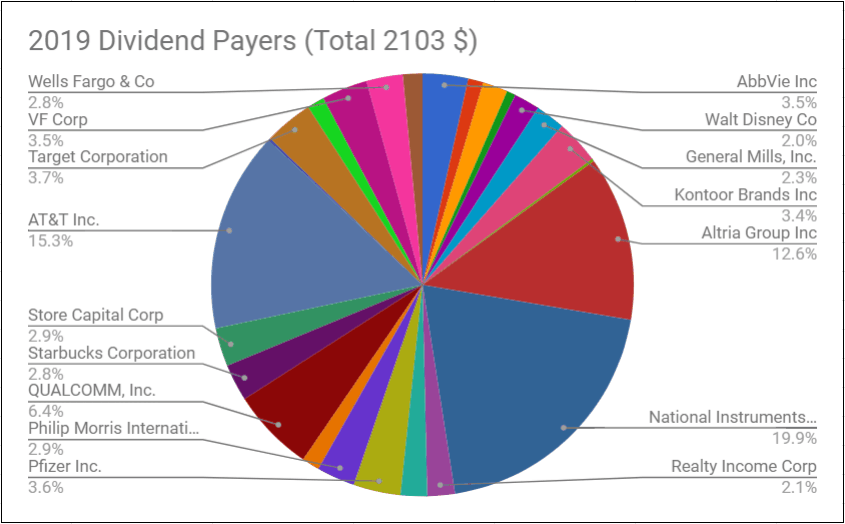

Here is how much percentage of the dividend income is coming from each of the 26 stocks in my portfolio:

My Buys in Q4 2019

- I added to my Cisco Systems (CSCO) position in Q4 2019 quarter. Cisco had fallen more than 20% from its highs. They reported a stellar fiscal year 2019. However, they gave weak guidance for fiscal 2020. They expected slowness due to trade war and Brexit uncertainty. CSCO seems pretty good by all dividend metrics. Great payout ratio and good cash position. Cisco is midst of transitioning from a purely hardware focused business to subscription recurring revenue business. They are getting into business of selling chips with Silicon One, getting into security and application analytics software. I like the direction and actions company is taking to future proof itself. Here is a detailed analysis on Cisco Systems and their dividend metrics.

- I also doubled my position in Pfizer. Pfizer had announcements related to spin off plans this quarter. This has lead the stock to tumble to where I originally bought its stock. I think Pfizer would make sure that the spin off their expired patents drugs plus new Pfizer will give same in dividend income before spin off. However, I am yet to decide if I want to keep or sell the spin off after it goes through.

I would expect my Q1 2020 quarterly dividend income to go up with help of these buys .

My Sells in this quarter

- None! I would like to see each quarter as this one in terms of selling.

Check out my complete dividend portfolio here.

This is how the market value is spread across various industries in my portfolio:

Performance for the year 2019

I was able to beat S&P 500 across my roth and traditional brokerage accounts. I did have 3 non dividend income paying stocks that also helped me to beat S&P in those accounts. My wife also started a roth account in 2019. We bought dividend income stocks in that too. Since we started it in middle of the year, I do not have concrete performance data on that. But I will track it in 2020.

Plans for 2020

Buy more dividend growth stocks in our roth accounts. Currently, I get 45% dividends from 3 stocks in my portfolio. I will try to increase my existing positions in some holdings. I am looking at $AOS and $WFC in the near term to add to.

Dividends stocks do come with some risk, but with precautions you can avoid the risky one’s and choose the best dividend paying/growing stocks for your portfolio. I prepared a guide where I discuss some key ratios, fundamentals, some important resources to look at while deciding to buy a dividend stock. Also find out how to get free access to Morningstar, Value Line, workaround paywall behind popular news sites like Seeking Alpha etc. Consider signing up for free instant access to the pdf version of the insights into dividend investing.